Let’s begin by affirming a core belief.

It’s one that our agency, CohereOne, considers foundational in terms of service to clients and our interactions with partners.

It’s one that the direct-to-consumer advertising ecosphere (inclusive of retail brands, as well as companies in service to those brands) deeply believes.

The best predictor of future behavior is relevant past behavior – especially when it comes to retail purchases.

For businesses we refer to as specialty retailers, the ‘reserve currency’ with respect to marketing intelligence is still transactional data. Brands like Abacus (acquired by Epsilon in 2007, which is now a wholly owned subsidiary of global agency conglomerate Publicis Groupe), Datalogix (acquired by Oracle in 2015), I-Behavior (acquired by Wunderman in 2010) and Wiland (any bets on who acquires them in the not-too-distant future?) are intimately linked to the success and growth of a generation of direct-to-consumer retail brands born in the halcyon days of offline specialty retail marketing – say, roughly 1990-2010.

So, what do the cooperative databases have in common? All require participation, in the form of transactional data – a give-to-get model. All go to market with lookalike modeling solutions – i.e., the best prospects for [brand x] are those whose buying characteristics resemble those observed among [brand x]’s existing customers. All deliver good-to-great ROI (return on investment) / ROAS (return on ad spend), albeit at the price of contributing to the equivalent success of one’s competitors, many of which are, you guessed it, fellow cooperative database participants.

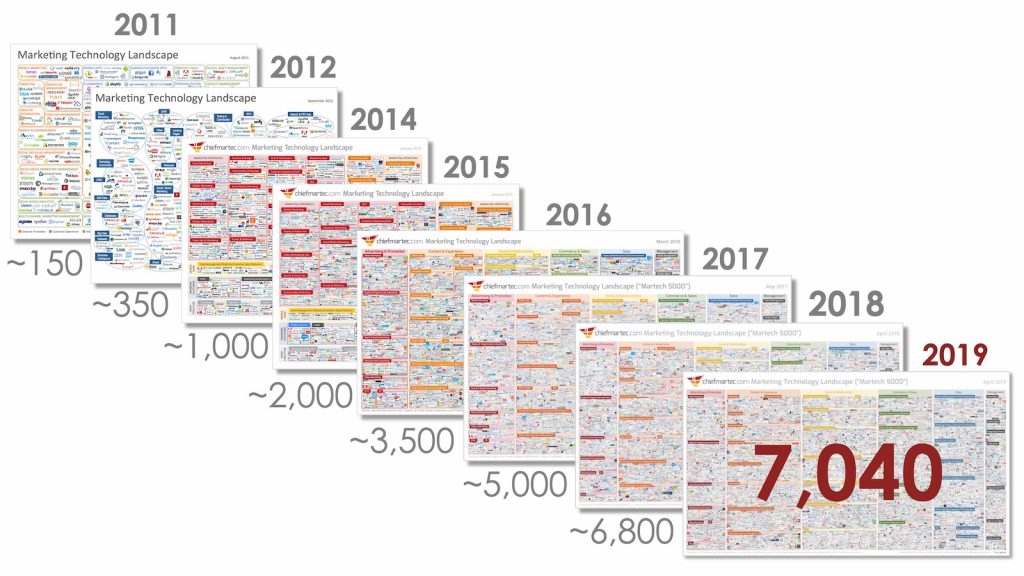

In their halcyon days, and for the direct-to-consumer stalwarts they served (and continue to serve), the cooperative databases truly were the best integrated solution for ad targeting and marketing intelligence. A new era for direct-to-consumer brands arose, one oriented towards the online / digital space, around 2010. The massive investment in internet infrastructure, as well as advertising and marketing technology software, a good amount of which was made during the first dot.com boom, was starting to pay off. Smartphones were poised to take over as individual’s primary content (i.e., advertising) consumption device. The first iteration of the adtech / martech landscape made its public debut in 2011. (Today, it references more than 7,000 companies! See infographic below to see MarTech through the years.)

Let’s highlight Facebook, who is poised as many retailer’s most and, conversely, least favorite ad platform. Sheryl Sandberg’s hiring as COO in 2008 was (to use Malcolm Gladwell’s term) a tipping point. The audience for general content consumption (mostly user-generated, in the early days) had already arrived, and she was tasked with monetizing it, via ‘discreetly presented’ ads. And monetize it, did she ever!

I focus on Facebook since they have coined the phrase ‘lookalike audiences’ in digital media buying circles. They, too, operate a cooperative database of sorts – there’s no first-party transactional data at play, though. (At least, not that which is delivered directly to Facebook by its users.)

So, what are Facebook’s lookalike audiences based on, if not transactional data? What non-transactional data elements are in Facebook’s marketing intelligence currency basket? And, since Facebook’s ad platform is notoriously referred to as a ‘walled garden’, what work-arounds and proxies are available to advertisers, since what Facebook knows about its users never gets packaged and re-sold to third parties? (Huh? What’s that you say about Cambridge Analytica? I’ve not heard of them.)

CohereOne has long promoted the use of multiple sources of marketing intelligence for the purposes of ad targeting. We have also voiced caution in equating customers acquired via social channels to those acquired through more traditional channels, like direct mail. (And don’t take it just from us. On this topic, I highly recommend the quick-read article titled “Beware…the Ring of Fire” by Ernesto Schmitt, Co-Founder of The Craftory, a London- and San Francisco-based investment house.)

Yes, the best predictor of future purchases is knowledge of relevant prior purchases. But, it is by no means a panacea. Facebook, and its less-prone-to-negative-press corporate counterpart, Instagram, collect accurate and timely information about its users’ buying intentions (even pre-intentions) and brand preferences. This information is great for isolating audiences who intend to buy a product or service like yours, or have a stated preference towards your brand, but can produce disappointing results when KPIs (key performance indicators) like CAC (customer acquisition cost) and LTV (lifetime value) are the final arbiters of a successful ad campaign.

It’s time to level set expectations relative to what certain data providers and ad platforms can deliver. Let’s accentuate the positives and focus in on core competencies:

- Transactional data (provided by the cooperative databases – Epsilon, Oracle, Wiland, Wunderman, Path2Response – and, more broadly, major financial institutions) is great at predicting those closest to the metaphorical bottom of the funnel – i.e., most likely to buy / transact.

- Non-transactional data (provided by an ever-widening array of companies, including: social media platforms and social signal aggregators, declared data / questions-based advertising companies, location data providers, life stage / life event data brokers) is great at identifying qualified individuals for top-of-funnel / initial engagement, cost effectively and at scale.

To the extent that the companies selling ad targeting and marketing intelligence are coherently integrating transactional and non-transactional data, that will be the measure of success as we see it as we roar into the 2020s. (We’re almost there, people!)

If you’re a CohereOne client, expect that our Account Management teams are challenging your ad targeting vendors to outperform their competition, as well as the results from your last campaign. If you’re not a CohereOne client, demand that your agency of record, or the vendors I’ve named. If you’re working directly with them, deliver on the promise of truly integrated marketing.

Please continue reading our blog posts here – send us your comments and feedback, too! We encourage you to forward our musings to your colleagues, and to others in our industry you think would find value in reading them.

Also, and of equal importance, follow CohereOne on LinkedIn, both for additional ‘organic content’ from our staff, as well as for interesting news and information about the retail, adtech and martech industries. We try to throw some #hashtaghumor into the mix often – because database marketing should be #fun!

Lastly – we promise not to assume you know what an industry acronym means. We’ll always put what it stands for (in parentheticals). Quiz: which of the following is the name of a popular Latin American boy band – CDP, CNCO, MAID, PCOA, or UX?