I’m going to revisit a portion of the pre-conference intensive session I presented that took place earlier this year at the Catalog and Integrated Marketing Summit in Chicago. I received feedback from many that it has changed the way they have been looking at their business and how they need to position their business for future success. This all revolves around understanding the difference in lifetime value (LTV) by the source of acquisition, and how that affects the value of your business in the future.

Lifetime value is a fairly easy metric to identify within any marketing database and can also be run as a “one off” report at any service bureau if the data is available. The basic premise of LTV is to identify the expected sales that a company should get in return over a period of time after a customer’s initial purchase. Most of the time we look at the 12-month value of a new customer and this time frame can usually be interchangeable with the term LTV.

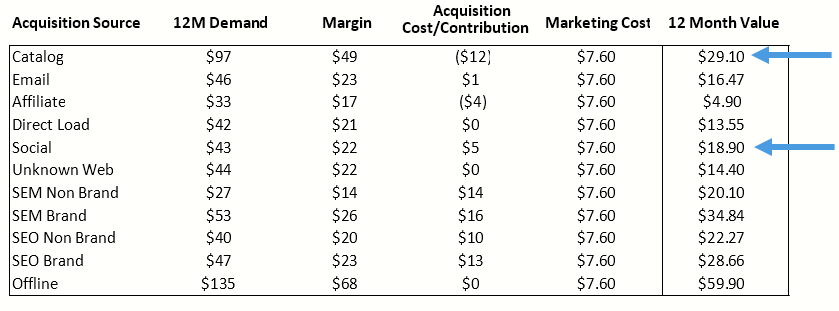

When evaluating LTV it is vitally important to keep the expected LTV separate from the initial purchase, since the initial purchase will have its own profit/loss that is associated with it. At the end of the day, the two are combined to get a full picture of the value of that customer. The chart below represents the full contribution calculation that takes place when evaluating LTV by source of acquisition.

The first lesson that is evident in the numbers, is that the 12-month demand is not equal across all acquisition sources based upon how you acquire that customer. The second lesson as evident in the 12-month value is that not all promotion channels are equal once all P/L factors are taken into account. Two polar opposite examples are Catalog and Social. In the case of Catalog, there is a negative acquisition cost, but because of the high 12-month demand, the full value at the end of 12-months is a positive $29. Conversely for Social, there is profit on the initial acquisition, but with low 12-month demand, at the end of the 12-month period their value is just slightly more than half that of the catalog.

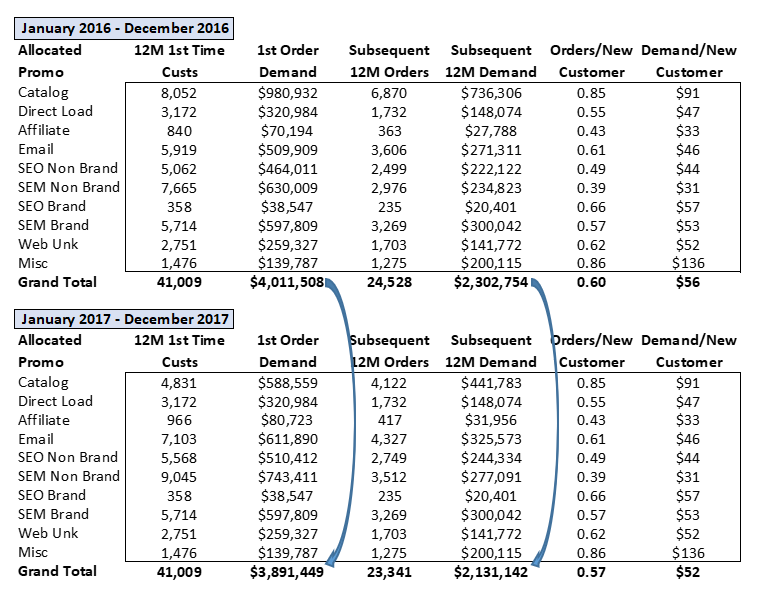

Understanding the value of your acquisition efforts is important, because they not only affect your short-term success, but also your long-term success. As marketing budgets are shifted from one promotional channel to another, this will have an effect on the value of your customer file in the future and can have unseen consequences on the performance of your business. The analysis below covers one of those consequences that are rarely considered.

The chart above represents the effect of a shift in the acquisition strategy year over year, away from catalog acquisition to digital acquisition programs. The total number of customers acquired are exactly the same at 41k, but the near-term value and 12-month value drops, a “double whammy.” The near-term value drops because the average order tends to be lower with digital programs, resulting in the 12-month value dropping due to the deflated value of the newly acquired customers (based upon how their channel of acquisition). In the 12-month example, overall demand drops by $291k (loss of first order + loss of 12-month demand) as a result of the shift in how those customers were acquired.

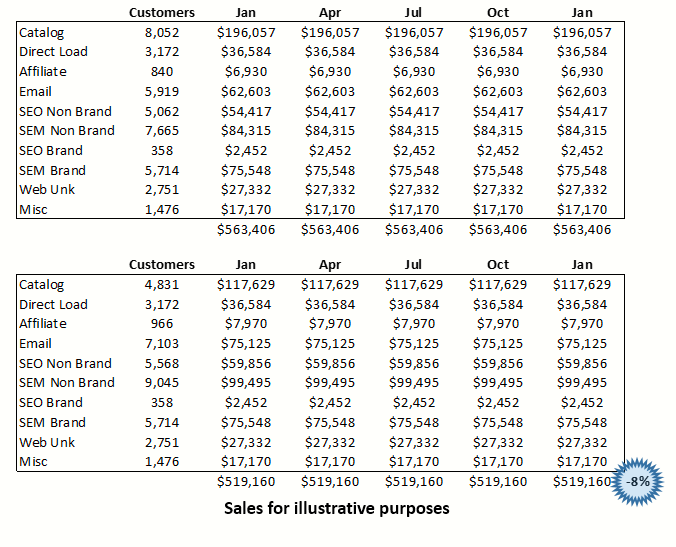

Another factor that is rarely considered when evaluating performance of your active file is whether this shift aligns with the makeup of your customers, such as comparing the $/book performance of your 12-month file year over year. If there is a significant shift in the distribution of your customer file, there will be a change in performance when all things are equal. Have you ever evaluated your catalog performance and saw a decline in performance that could not be explained by any of the normal factors that affect performance? Chances are it would be related to the shift in the value of your customer base, based upon the changes to your acquisition strategy and sources. The chart below illustrates that effect.

I’m using the same distribution of customer acquisition as the previous example, where the total customer count is the same, but acquisition shifts from catalog to digital. Based upon the 12-month demand of each of those customer groups, the sales at the end of the period would vary. Then in the following January when the active file is mailed the catalog, their $/B performance would automatically be reduced by 8% compared to the prior January, simply as a result of the change in distribution of how you are acquiring customers.

Then intent of this lesson is not to call out one marketing channel as superior over another, as they all have value and can work symbiotically in driving acquisition, retention, and reactivation success. Rather, the intent is to highlight the need to understand the data, understand that changes have consequences, (some easily identified and others not) and to ensure that you proactively plan for changes in the value of your customer file. Even more important is to run this type of analysis on your business in order to better understand and validate trust in the data to be fully informed of potential advantages and unintended consequences when making impactful business decisions.

Did I mention that you should understand and trust the data, because it doesn’t lie!

If you have any other questions, please feel free to reach out to me at tseaton@cohereone.com

As usual, thoughtful analysis in understandable language. Thanks, Travis! I am going to forward this to a couple of my clients who are having difficulty bucking the pressure to reduce catalog circulation by web-minded management.

Hi Chari

Beth Cooke