Want to discover the latest industry developments for March 2024? Gain valuable insights with in-depth analyses from more than 100 diverse brands, uncovering key trends shaping the landscape.

March 2024: Spring Softness

After a strong February, shoppers took a breath in March. Demand for apparel remained strong, and home and furniture retailers saw improving market conditions. However, many brands were down slightly compared to last year.

After a strong February, shoppers took a breath in March. Demand for apparel remained strong, and home and furniture retailers saw improving market conditions. However, many brands were down slightly compared to last year.

Overall, our outlook for 2024 remains optimistic. Consumers continue to be resilient, economic indicators suggest inflation is moderating, and the stock market continues to surge.

While the economy’s pace is expected to cool in the coming months, steady growth is still anticipated. The National Retail Federation forecasts retail sales will increase between 2.5% and 3.5% in 2024, normalizing growth to pre-pandemic levels. We will keep a watchful eye on this moving into Q2.

March 2024 Marketing Trends

Trend #1: Building Customer Relationships with Packaging and Pop-Up Stores

While many retailers operate primarily online, there’s a growing desire to build in-person relationships. Brands are creating in-person experiences through pop-up shops and product packaging to bridge online and offline.

Pop-ups are on the rise. In March, Nordstrom launched a dedicated space for brands inside its flagship New York City Store. Canadian furniture brand Sunday recently opened a pop-up in LA, a move that they expect to lift web traffic. According to Capital One, pop-up shops are projected to generate more than $95 billion annually by 2025.

Packaging and unboxing experiences offer another opportunity for brands to be authentic and consistent across mediums. The unboxing experience is often a customer’s first impression of the brand, emphasizing the need for it to be compelling.

Trend #2: Maximizing Hyper-personalization amongst customer privacy

Brands that focus on delivering a hyper-personalized customer experience have a competitive edge. Consumers will increasingly expect and prefer brands that offer an experience tailored to their specific needs, with personalized product recommendations and solutions. However, the challenge for brands will be to balance this desire for personalized offline and online experiences with customer privacy regulations, while ensuring that the data provided is used accurately and effectively.

Trend #3: USPS offers deep discounts to users in hopes of increasing volume and revenue in 2024

The United States Postal Service has recently launched a growth incentive program that offers significant savings to customers who mail over 1 million pieces annually. Once a customer mails over 1 million pieces, they receive a 30% discount. Additionally, customers who sent more than 1 million pieces in the previous year will receive the discount once they exceed last year’s circulation. This program is a vital initiative by USPS to boost the volume of mail and revenue while also providing considerable savings to their biggest clients. While other incentive programs offer discounts ranging from 2-5%, brands that mail frequently or in large volumes can expect significant savings this year.

Jump to Section

Marketing KPIs: March 2024 Trends by Industry

Marketing KPIs: March 2024 Trends by Company Revenue

$100M+ | $15M-$100M | $0-$15M

Marketing KPIs: March 2024 Trends by Industry

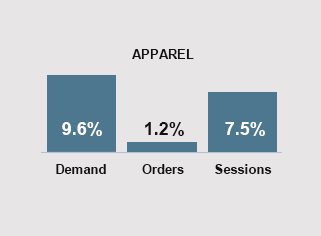

Apparel Growth Continues

Apparel brands are experiencing success by increasing prices and average order values. The growth is expected to continue. Sales of apparel, accessories, and footwear in the US are predicted to reach approximately $205 billion in the current year. As orders continue to increase, apparel companies should focus on improving or maintaining conversion rates. The significant rise in web traffic clearly indicates consumer interest in apparel and the effectiveness of marketing efforts.

Apparel brands are experiencing success by increasing prices and average order values. The growth is expected to continue. Sales of apparel, accessories, and footwear in the US are predicted to reach approximately $205 billion in the current year. As orders continue to increase, apparel companies should focus on improving or maintaining conversion rates. The significant rise in web traffic clearly indicates consumer interest in apparel and the effectiveness of marketing efforts.

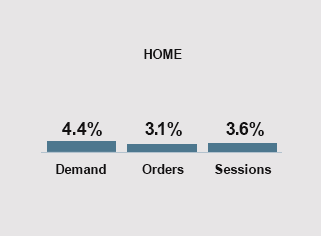

Home Brands Showed Promise in March

The demand for furniture has grown slightly faster than the number of orders and sessions, which could be due to up-selling and cross-selling techniques. Furniture retailers are also finding that flexible payment options are becoming increasingly important for customers. The rise in the number of orders by 3.13% is a positive sign. Many furniture brands are using augmented reality (AR) and virtual reality (VR) to enhance the e-commerce experience for their customers. The increase in sessions indicates more engagement, and home brands have maintained their conversion rates, allowing them to take advantage of this growth.

The demand for furniture has grown slightly faster than the number of orders and sessions, which could be due to up-selling and cross-selling techniques. Furniture retailers are also finding that flexible payment options are becoming increasingly important for customers. The rise in the number of orders by 3.13% is a positive sign. Many furniture brands are using augmented reality (AR) and virtual reality (VR) to enhance the e-commerce experience for their customers. The increase in sessions indicates more engagement, and home brands have maintained their conversion rates, allowing them to take advantage of this growth.

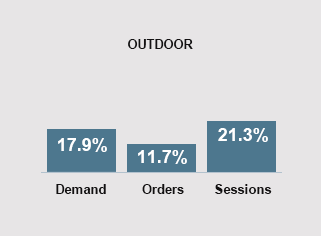

Competition is Heating Up for Outdoor Brands

The decrease in average order values is a result of a growing off-price trend, especially in hard goods. On the other hand, the slight increase in orders might be due to effective marketing or promotional activities or illustrate a stabilization in consumer demand for outdoor products. Moreover, the increase in sessions suggests that customers remain interested in outdoor products. The March figures demonstrate a consistent pattern of declining demand and increasing participation, which many outdoor brands have experienced.

The decrease in average order values is a result of a growing off-price trend, especially in hard goods. On the other hand, the slight increase in orders might be due to effective marketing or promotional activities or illustrate a stabilization in consumer demand for outdoor products. Moreover, the increase in sessions suggests that customers remain interested in outdoor products. The March figures demonstrate a consistent pattern of declining demand and increasing participation, which many outdoor brands have experienced.

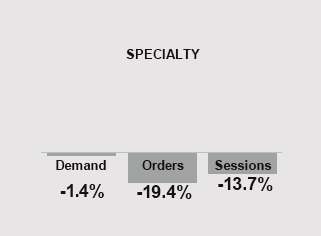

Specialty Retailers Commanding Higher Prices

Despite the significant decrease in orders for specialty retailers, demand remained nearly flat compared to last March due to high average order values. This decline in orders by 19.38% may indicate changes in consumer behavior or less traffic. Many consumers are now more focused on value and less likely to splurge. Specialty brands experienced a significant decrease in sessions compared to March last year. However, any improvements made through acquisition and retention efforts could be beneficial if brands can continue to maintain high AOVs.

Despite the significant decrease in orders for specialty retailers, demand remained nearly flat compared to last March due to high average order values. This decline in orders by 19.38% may indicate changes in consumer behavior or less traffic. Many consumers are now more focused on value and less likely to splurge. Specialty brands experienced a significant decrease in sessions compared to March last year. However, any improvements made through acquisition and retention efforts could be beneficial if brands can continue to maintain high AOVs.

Marketing KPIs: March 2024 Trends by Company Revenue

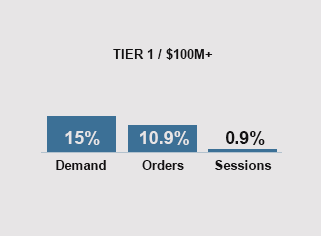

Tier 1 Brands: Growth Continues

Tier 1 brands are experiencing a surge in demand, with average order values on the rise. In March, many Tier 1 brands saw orders increase by over 10%, indicating strong conversion rates. Retailers are achieving success with their retention and reactivation programs, while large brands are benefiting from investments in apps, loyalty programs, and retargeting campaigns. However, the sessions have only slightly increased compared to last March. Considering this, Tier 1 brands may benefit from exploring additional acquisition efforts.

Tier 1 brands are experiencing a surge in demand, with average order values on the rise. In March, many Tier 1 brands saw orders increase by over 10%, indicating strong conversion rates. Retailers are achieving success with their retention and reactivation programs, while large brands are benefiting from investments in apps, loyalty programs, and retargeting campaigns. However, the sessions have only slightly increased compared to last March. Considering this, Tier 1 brands may benefit from exploring additional acquisition efforts.

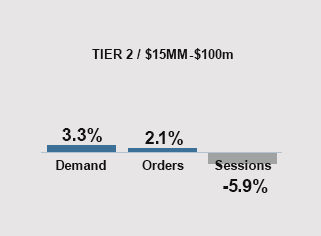

Tier 2 Brands: Making Gains

Tier 2 brands experienced only slight increases in demand. Although customers are spending more overall, raising the average order values is still challenging. On a positive note, the conversion rates have improved in March. This suggests that customer acquisition and retention efforts are proving to be successful. Seasonal promotions or product assortment enhancements may also contribute to the increase. However, many Tier 2 brands experienced a decline in traffic during March, indicating that it is important to focus on monitoring customer engagement and acquisition efforts in the coming months.

Tier 2 brands experienced only slight increases in demand. Although customers are spending more overall, raising the average order values is still challenging. On a positive note, the conversion rates have improved in March. This suggests that customer acquisition and retention efforts are proving to be successful. Seasonal promotions or product assortment enhancements may also contribute to the increase. However, many Tier 2 brands experienced a decline in traffic during March, indicating that it is important to focus on monitoring customer engagement and acquisition efforts in the coming months.

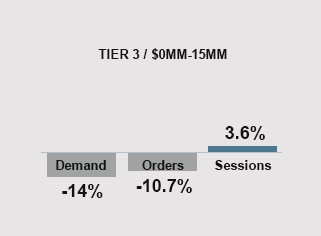

Tier 3 Brands: Conversion Challenges

Demand for Tier 3 brands was lower than last March. Consumers are still worried about prices, and their spending behaviors have changed. They are spending more on recreation, restaurants and entertainment than the previous year. Conversion rates were also down compared to last March. As there has been an increase in sessions, brands should consider using additional browse or cart abandoned retargeting programs. The decline in demand and orders suggests that even though more people are visiting the website, they are not making purchases. Conversion is the biggest challenge for Tier 3 brands.

Demand for Tier 3 brands was lower than last March. Consumers are still worried about prices, and their spending behaviors have changed. They are spending more on recreation, restaurants and entertainment than the previous year. Conversion rates were also down compared to last March. As there has been an increase in sessions, brands should consider using additional browse or cart abandoned retargeting programs. The decline in demand and orders suggests that even though more people are visiting the website, they are not making purchases. Conversion is the biggest challenge for Tier 3 brands.