Want to discover the latest industry developments for February 2024? Gain valuable insights with in-depth analyses from more than 100 diverse brands, uncovering key trends shaping the landscape.

February 2024: Robust Performance

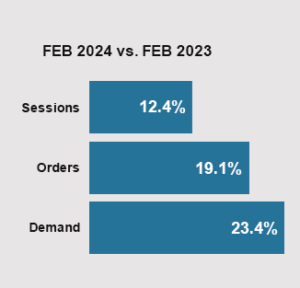

In February, there was significant growth in online activity, with sessions up by 12% year-over-year (YOY), indicating increased traffic to the platform. Additionally, orders surged by 19% YOY, reflecting a substantial rise in purchases made through the website or service. Moreover, demand saw a remarkable increase of 23% YOY, indicating heightened interest and consumer engagement with the products or services offered.

In February, there was significant growth in online activity, with sessions up by 12% year-over-year (YOY), indicating increased traffic to the platform. Additionally, orders surged by 19% YOY, reflecting a substantial rise in purchases made through the website or service. Moreover, demand saw a remarkable increase of 23% YOY, indicating heightened interest and consumer engagement with the products or services offered.

With February coinciding with the start of tax season in many regions, the surge in online activity towards the end of February may also be attributed to consumers seeking everyday purchases, paying off debt, home improvement and vacations. This presents an opportunity for targeted marketing efforts tailored towards addressing tax-related needs and offering relevant solutions. Leveraging this seasonal trend, businesses can further capitalize on the increased demand and drive engagement through strategic promotions and messaging.

Looking ahead to the marketing outlook for March, this positive trend in online activity presents opportunities for strategic marketing initiatives. Leveraging the increased traffic, purchases, and demand, the focus could be on further enhancing brand visibility, optimizing conversion rates, and capitalizing on consumer interest through targeted campaigns and promotions. With a robust online presence and growing demand, the outlook for February presents promising prospects for continued growth and success.

February 2024 Marketing Trends

Trend #1: Optimism and Caution: Forecasters Elevate US Economic Expectations for 2024 while JP Morgan CEO Exercises Caution

According to recent surveys, the U.S. economy will experience stronger growth than initially projected, with economists forecasting a 2.2% growth rate for the year, up from the previous estimate of 1.3%. Despite concerns regarding high-interest rates and inflation, the economy has shown a robust job market and household spending. Cooling inflation has also led to expectations of interest rate cuts by mid-June. However, public frustration with inflation remains a significant issue. The Federal Reserve is anticipated to implement rate cuts to alleviate economic pressure, although the effects may take time to manifest.

Despite the positive outlook by some, Jamie Dimon, CEO of JP Morgan, voices concerns about excessive optimism, questioning the likelihood of a smooth landing for the U.S. economy. Dimon highlights potential vulnerabilities in sectors like commercial real estate and regional banks due to higher interest rates. While he thinks a recession is possible, should it occur, broader macroeconomic impacts will likely be limited. His nuanced perspective offers insight into the interplay of economic factors and their implications for different segments of the economy.

Trend #2: Pay by Bank

Retailers are actively exploring alternatives to circumvent credit card processing, with Pay-by-Bank options such as Plaid and Stripe emerging as standout solutions, often offering substantial savings of 2-4 times greater compared to traditional credit card fees. This trend signifies a shift towards smoother payment processes, eliminating the need for repeated bank detail entries. While these methods promise cost advantages for merchants, challenges like integrating real-time payments and dispute resolution persist. Despite hurdles, there’s a hopeful outlook for the growth of Pay-by-Bank, supported by suggestions for industry collaboration and leveraging existing payment infrastructure like ACH.

Read more on Retail Dive.

Trend #3: Home Brands Keep Raising the Bar on Experiential Shopping

Crate & Barrel unveiled a new flagship location in a multi-story building in the historic Flatiron district. While it does have more of everything (swatches, hardware, design experts), the real news is that you don’t have to visit the Flatiron District to experience the store. In a first for the brand, Crate & Barrel launched a virtual version of the store that customers can experience and shop virtually.

Crate & Barrel unveiled a new flagship location in a multi-story building in the historic Flatiron district. While it does have more of everything (swatches, hardware, design experts), the real news is that you don’t have to visit the Flatiron District to experience the store. In a first for the brand, Crate & Barrel launched a virtual version of the store that customers can experience and shop virtually.

Home decor retailer Reformation has added in-store interactive digital displays where customers use an iPad to build a selection of items for an associate to bring to their dressing room. From there, the shopper can change the lighting and music and request new sizes from the iPad. In this move, Reformation has unlocked a new level of customer data when it comes to in-store shopping.

Read more: NRF, PR NewsWire, Forbes

Trend #4: Rankings for Best Superbowl Commercials Vary by Research Outfit and Methods

Adweek compared the results of Superbowl ad testing research firms against one another, pitting AI-ranked Kantar against audience-sourced System1, and they didn’t agree. Different ranking systems make comparison a little tricky, but While Kantar chose Booking.com’s Tina Fey led ad, the human audience chose Michelob Ultra’s ad as the top pick.

Accelerant research conducts a small test of n=250 consumers, ranking the ads on a thorough list from brand recall to intent. The Cheerios “take heart” commercial scored the highest purchase intent, while Mountain Dew’s ad featuring Aubrey Plaza took the top spot in both brand recall and engagement.

Read more at Adweek, Accelerant Research

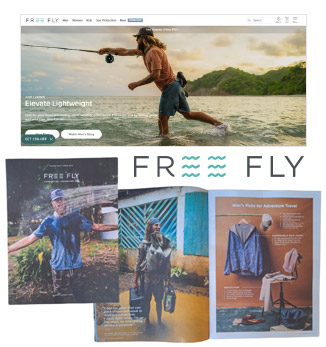

Trend #5: Free Fly Masterfully Blends Brand Storytelling with Selling in Spring Catalog

For this adventure, Free Fly embarked on a journey to Costa Rica with professional fishing guides and brand ambassadors Alec Lucas and Sage Johnson. The mission: to capture the essence of adventure through on-location photography, as they curated a selection of their must-haves for exploratory travel. Meticulously designed, the catalog integrates print and digital, inviting the shopper to dynamic video content online using QR codes. The narrative comes full circle on the website, as the story continues on the home page.

For this adventure, Free Fly embarked on a journey to Costa Rica with professional fishing guides and brand ambassadors Alec Lucas and Sage Johnson. The mission: to capture the essence of adventure through on-location photography, as they curated a selection of their must-haves for exploratory travel. Meticulously designed, the catalog integrates print and digital, inviting the shopper to dynamic video content online using QR codes. The narrative comes full circle on the website, as the story continues on the home page.

Ed. note: J.Schmid did not create this catalog, but we’re frequent admirers. Free Fly is a valued partner of CohereOne.

See more at Free Fly

Jump to Section

Marketing KPIs: February 2024 Trends by Industry

Marketing KPIs: February 2024 Trends by Company Revenue

$100M+ | $15M-$100M | $0-$15M

Marketing KPIs: February 2024 Trends by Industry

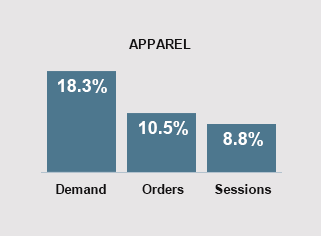

Apparel Flourishes Across the Board

Apparel retailers are witnessing notable year-over-year (YOY) growth, with online shopping retaining its prominence among consumers in the apparel and fashion sector. This trend is marked by consumers displaying higher conversion rates and demonstrating an inclination to spend more per order.

Apparel retailers are witnessing notable year-over-year (YOY) growth, with online shopping retaining its prominence among consumers in the apparel and fashion sector. This trend is marked by consumers displaying higher conversion rates and demonstrating an inclination to spend more per order.

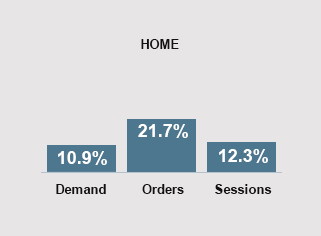

Home Brands’ Modest Growth Amid Discount Utilization

Home brands experienced year-over-year growth in February, with increased sessions, orders, and demand. However, the rise in orders outpaces the rise in demand suggests that factors like discounts or promotions may be driving more orders. While increased orders may seem positive, relying too heavily on discounts could impact long-term profitability. Businesses should carefully assess pricing strategies and promotions to maintain profitability and sustainability.

Home brands experienced year-over-year growth in February, with increased sessions, orders, and demand. However, the rise in orders outpaces the rise in demand suggests that factors like discounts or promotions may be driving more orders. While increased orders may seem positive, relying too heavily on discounts could impact long-term profitability. Businesses should carefully assess pricing strategies and promotions to maintain profitability and sustainability.

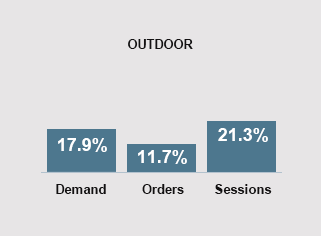

Outdoor Brands Experience Surge as Consumers Gear Up for Spring

The outdoor industry is experiencing significant growth across key metrics. Sessions have surged by 21%, orders by 12%, and demand by 18% compared to the previous year. These trends reflect a growing interest in outdoor activities and products, likely influenced by shifting consumer lifestyles and a heightened focus on health and wellness. This presents valuable opportunities for businesses in the outdoor sector to cater to the evolving preferences of outdoor enthusiasts and capitalize on this increased demand.

The outdoor industry is experiencing significant growth across key metrics. Sessions have surged by 21%, orders by 12%, and demand by 18% compared to the previous year. These trends reflect a growing interest in outdoor activities and products, likely influenced by shifting consumer lifestyles and a heightened focus on health and wellness. This presents valuable opportunities for businesses in the outdoor sector to cater to the evolving preferences of outdoor enthusiasts and capitalize on this increased demand.

Specialty Retailers See Slight Uptick in Demand

Specialty retailers notice a slight increase in demand despite fewer sessions and orders compared to last year. This indicates higher average order values alongside reduced purchasing activity among existing customers.

Specialty retailers notice a slight increase in demand despite fewer sessions and orders compared to last year. This indicates higher average order values alongside reduced purchasing activity among existing customers.

Marketing KPIs: February 2024 Trends by Company Revenue

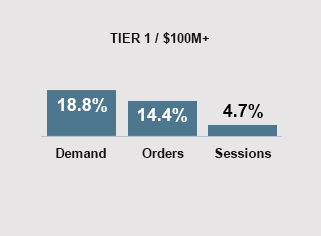

Tier 1 Brands: Surge in Demand Sparks Growth: Notable Increase in Orders and Sessions

Top-tier brands have seen a significant uptick in demand, marking a robust 18.8% increase compared to the previous period. This surge is paralleled by a noteworthy 14.4% rise in orders and a remarkable 4.7% surge in website sessions. These trends suggest that consumers are actively capitalizing on the tax season, leading to higher average order values (AOVs) and enhanced conversion rates. As tax refunds provide additional spending power, shoppers are showing increased engagement and willingness to make purchases, driving the overall growth for Tier 1 brands.

Top-tier brands have seen a significant uptick in demand, marking a robust 18.8% increase compared to the previous period. This surge is paralleled by a noteworthy 14.4% rise in orders and a remarkable 4.7% surge in website sessions. These trends suggest that consumers are actively capitalizing on the tax season, leading to higher average order values (AOVs) and enhanced conversion rates. As tax refunds provide additional spending power, shoppers are showing increased engagement and willingness to make purchases, driving the overall growth for Tier 1 brands.

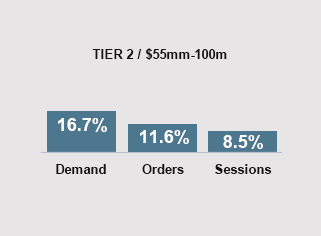

Tier 2 Brands: Substantial Expansion

Tier 2 brands have seen significant growth, highlighted by a 16.7% increase in demand, accompanied by a substantial 11.6% rise in orders, and an 8.5% uptick in sessions. These metrics indicate a noteworthy surge in Average Order Value (AOV) and conversion rates, reflecting positively on the brand’s performance and customer engagement.

Tier 2 brands have seen significant growth, highlighted by a 16.7% increase in demand, accompanied by a substantial 11.6% rise in orders, and an 8.5% uptick in sessions. These metrics indicate a noteworthy surge in Average Order Value (AOV) and conversion rates, reflecting positively on the brand’s performance and customer engagement.

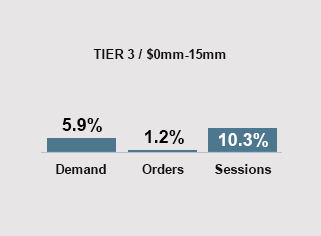

Tier 3: Surge in Performance

In February, Tier 3 brands made a strong comeback, showcasing consumers’ preference for supporting small businesses. There was a 1.2% rise in orders, accompanied by a 5.9% increase in demand and a significant 10.3% surge in sessions. The disparity between demand and orders suggests that consumers are spending more per order on average, highlighting a positive trend for these smaller businesses.

In February, Tier 3 brands made a strong comeback, showcasing consumers’ preference for supporting small businesses. There was a 1.2% rise in orders, accompanied by a 5.9% increase in demand and a significant 10.3% surge in sessions. The disparity between demand and orders suggests that consumers are spending more per order on average, highlighting a positive trend for these smaller businesses.