We compiled these trends from over 100 brands, comparing year-over-year data for November, adjusted for Cyber Monday.

November 2024: Navigating a Compressed Holiday Season

November presented unique challenges as Thanksgiving fell on November 28, creating a compressed holiday shopping season. Retailers responded with early promotions, including Amazon’s October “Prime Big Deals Days,” reshaping shopping timelines compared to last year.

Overall sessions increased 1.31%, driven by Apparel and Tier 2 categories, but orders fell 3.21%, and demand dropped 7.97%. Outdoor and Specialty Brands faced the greatest challenges, reflecting broader struggles compared to stronger performance last year. U.S. retail sales rose 0.7% overall, though gains were uneven across sectors.

Inflation continues to influence cautious spending, with consumers relying on credit and installment options to manage budgets. The late Thanksgiving condensed Black Friday and Cyber Monday into a shorter, more intense shopping window, forcing retailers to adjust strategies.

Compared to 2023, November 2024 highlighted shifting consumer behaviors and the need for early, targeted campaigns. Retailers who adapted quickly to these changes found opportunities despite the hurdles.

November 2024 Marketing Trends

Trend #1: 2024 Holiday Season: The Final Push

With Christmas days away, retailers can employ strategic measures to maximize the final holiday shopping rush.

Flexible fulfillment options like buy online, pick up in-store (BOPIS) and same-day delivery can help cater to last minute shoppers, over with over 40% planning to use BOPIS this year. Omnichannel experiences continue to gain traction as shoppers blend online and in-store purchases. Retailers are also leveraging data to personalize marketing messages and recommend products, enhancing customer engagement.

Mobile optimization is critical, with simplified checkout processes ensuring seamless shopping on smartphones. Meanwhile, in-store events and festive atmospheres encourage foot traffic by creating experiences that stand out from online shopping.

By combining personalization, convenience, and creativity, retailers aim to meet consumer expectations while maximizing sales during the crucial holiday countdown.

Trend #2: Understanding the Impact of “Buy Now, Pay Later” on Retail and Consumer Behavior

Buy Now, Pay Later (BNPL) is revolutionizing the retail landscape, influencing consumer spending habits and offering opportunities and challenges for retailers. Recent studies indicate that BNPL substantially enhances consumer engagement, increasing purchase likelihood by 10% and basket sizes. These changes are most noticeable among consumers who previously spent less, unlocking untapped spending potential. BNPL’s installment model empowers consumers, making large purchases more feasible.

Key Retailer Benefits:

- Increased Sales and Basket Sizes: BNPL encourages larger purchases through staggered payments, motivating consumers to add more to carts.

- Appeal to Younger Consumers: Millennials and Gen Z are primary adopters, with 75% planning to use BNPL for cost management. BNPL’s convenience and digital focus align with these demographics.

- Improved Conversion Rates: Flexible payment options reduce checkout friction, decreasing cart abandonment.

By adopting BNPL, retailers can boost sales and foster long-term growth. Balancing benefits with potential pitfalls will be vital as BNPL evolves.

Trend #3: Recommerce: How Leading Brands are Redefining Item Resale

Recommerce, the resale of pre-loved and excess items, is taking the retail world by storm as consumers seek wallet-friendly and eco-conscious shopping alternatives. Here’s how leading brands are redefining the recommerce landscape:

- ThredUp and Fashion Giants: ThredUp collaborates with brands like COS to establish unique resale platforms, meeting consumer demand for quality pre-owned items. This trend marks a broader shift as luxury and fast-fashion brands explore controlled resale avenues.

- IKEA’s Circular Hub: IKEA expands its Circular Hub, offering gently used furniture and home goods to environmentally aware shoppers. This program spotlights IKEA’s dedication to sustainability while delivering affordable solutions.

- Patagonia Worn Wear: Patagonia’s thriving Worn Wear program offers repaired and repurposed outdoor gear, reinforcing the brand’s commitment to sustainability and fostering customer loyalty through its focus on quality and eco-friendliness.

- Gucci Vault curates vintage pieces, while Burberry and Stella McCartney have introduced resale or rental options, reflecting an industry-wide commitment to sustainability.

Recommerce is more than just a sustainability play; it addresses evolving consumer desires for distinct, affordable shopping experiences. Retailers adopting this model strike a balance between profitability and social responsibility. As the market expands, recommerce innovations will become increasingly crucial to retail success.

Trend #4: Bringing the Power of Light to Retail

Retailers are upping their game, using the magic of light and innovative store designs to enchant customers and turn shopping trips into unforgettable journeys.

Check out these mesmerizing trends and real-world examples:

- Lighting that Tells Tales: Nike and Adidas create wonderlands with dynamic, synced lighting transforming store areas into immersive wonderlands. Lights sync with digital displays for a seamless experience that thrills the senses.

- Nature’s Embrace: Greenery and organic materials bring serenity indoors. Soft lighting and organic materials turn these spaces into serene havens, enticing shoppers to linger longer.

- Stores as Adventure Lands: Interactive displays and events turn stores into destinations. Nike takes it a step further, with stores featuring customization studios and dynamic lighting trial zones that simulate real-world environments for athletic gear testing.

- Dimensional Delights: Goodbye flat, 2D layouts – hello, layered displays and organic shapes that add depth and flair to stores!

- Customized Luxury: Brands like Louis Vuitton and Apple use artistic LED lighting to elevate ambiance and guide shoppers. These tailor-made creations elevate store ambiance while strategically guiding shoppers to key areas.

Innovative store designs and dynamic lighting unite aesthetics with practicality, offering retailers a winning edge while forging deep emotional connections with customers.

Jump to Section

Marketing KPIs: November 2024 Trends by Industry

Marketing KPIs: November 2024 Trends by Company Revenue

$100M+ | $15M-$100M | $0-$15M

Marketing KPIs: November 2024 Trends by Industry

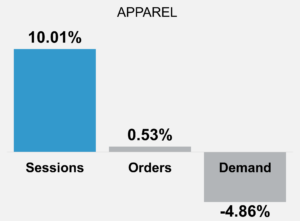

Apparel Industry

- Sessions Increased +10.01%: Apparel brands saw increased browsing activity, before and after Thanksgiving.

- Orders Were Up +0.53%: Orders were up slightly compared to November 2023. Fashion brands saw the greatest increases. However, average order values (AOVs) were down -3.29%.

- Demand Decreased -4.86%: Overall demand was down compared to LY. Wallet share for clothing has increased for consumers 18-34, and 35-54, while those 55 and over appear to be spending less.

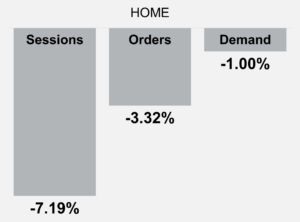

Home Brands

- Sessions Decreased -7.19%: Consumers appear to be browsing less. Home retailers saw sessions down compared to November 2023.

- Orders Decreased -3.32%: Home accessories saw a greater decline than home furnishings. Consumers, less willing to splurge, have impacted accessory and kitchen orders, more than furniture.

- Demand Was Down -1.00%: November demand was lower for home brands. However, home saw a smaller decrease compared to other industries.

Outdoor Brands

- Sessions were Down -0.57%: Outdoor brands saw a minor dip in web traffic.

- Orders Decreased -6.51%: Conversion continues to be a challenge for outdoor brands and retailers. Hardgoods and equipment have seen the greatest decline. Units sold also declined for many brands.

- Demand Declined -9.40%: Overall, demand was down compared to November 2023. 60% of brands also saw lower AOVs. The industry continues to be promotional, particularly outdoor apparel.

Specialty Retailers

- Sessions were Down -3.17%: Sessions were down for year-over-year for specialty brands in November.

- Orders Decreased -5.92%: Orders wear also down as conversion rates declined for specialty retailers. Gift and luxury brands saw the greatest decrease.

- Demand Decreased -10.51%: Consumer demand for specialty products continues to wane. In addition, brands have been increasingly promotional, impacting AOVs.

Marketing KPIs: November 2024 Trends by Company Revenue

Tier 1 Brands

- Sessions Decrease -1.99%: The slight drop in sessions, reflects stable engagement for Tier 1 brands. Strong loyalty supports market leaders, but expanding to new audiences is crucial for growth.

- Orders Decreased –0.55%: Orders were also down slightly, likely due to seasonal competition and consumers delaying purchases.

- Demand Declined –12.24%: The steep decline likely indicates intensified reliance on discounts and promotions, impacting AOVs.

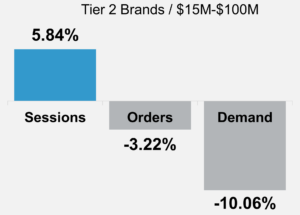

Tier 2 Brands

- Sessions Increased +5.84%: After an increase in October sessions, Tier 2 brands continue to see traffic grow. Larger brands typically dominate online ad spaces during peak holiday periods edging out brands with smaller ad budgets.

- Orders Decreased –3.22%: Orders were down for Tier 2 brands, indicating potential shifts in consumer behavior or a lack of promotional effectiveness.

- Demand Decreased –10.06%: The drop in demand reflects lower spending per transaction, while the decline in orders indicates fewer purchases overall. This suggests that customers are spending less and buying less frequently, likely due to increased competition, economic pressures, and shifting consumer priorities.

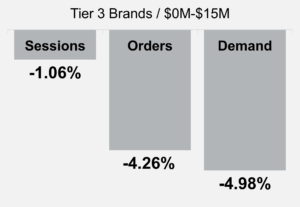

Tier 3 Brands

- Sessions Decreased -1.06%: Tier 3 brands saw a small decline in sessions compared to November 2023. Many Tier 3 brands face intense competition from larger retailers with bigger advertising budgets and more extensive product ranges this time of year.

- Orders Decreased -4.26%: After a small +0.71% boost in orders during October of this year, orders declined in November. Drops in orders aligned with the overall reduction in traffic and demand, indicating that shoppers are browsing but not committing to the purchase.

- Demand Decreased -4.98%: Demand dropped significantly this month, though early promotions and discounts initially drove consumer interest. The decline suggests smaller brands are struggling in a saturated market, where consumer attention and spending are dominated by larger retailers offering aggressive discounts.