We compiled these trends from over 100 brands, comparing year-over-year data for the date range September 1, 2025, to September 30, 2025.

September 2025: Conversion Gains Amid Soft Traffic

September began with strong momentum for many retailers, buoyed by Labor Day weekend promotions. However, performance tapered off in the latter half of the month. Many home retailers and brands with high average order values saw growth. In contrast, apparel and specialty brands saw flat or modest declines, reflecting continued softness in discretionary spending.

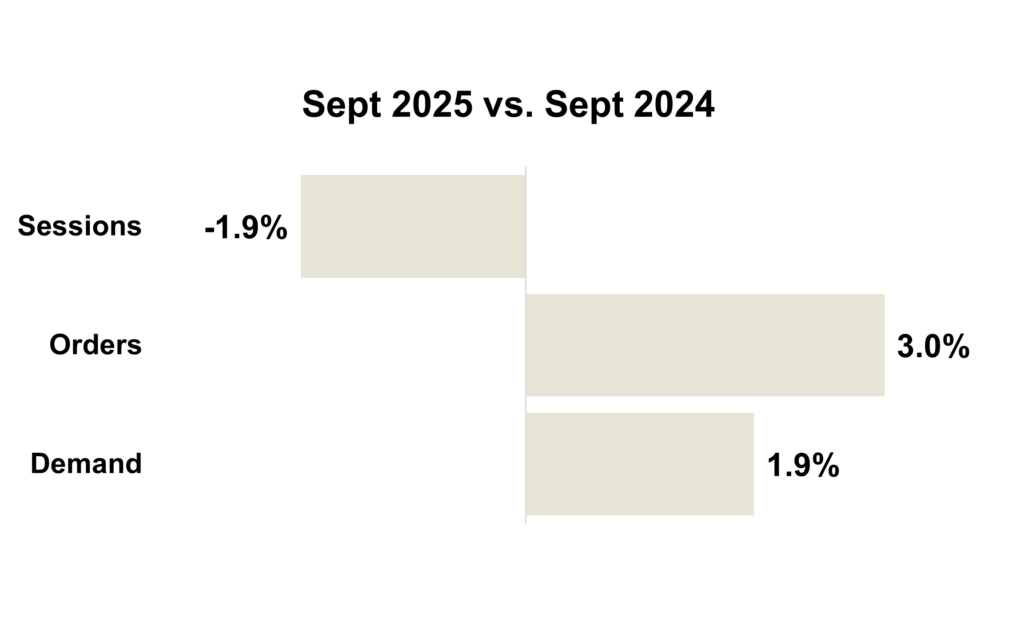

Overall, sessions declined -1.9% versus last September, but improved conversion lifted orders by 3% and demand by 1.9%. Although fewer shoppers browsed, those who did were more likely to make a purchase.

Despite stable economic indicators and record-high stock markets, consumer sentiment remains low. The University of Michigan’s index held at 55.0, down 22% year-over-year. Moody’s reports the top 10% of earners now drive nearly half of all retail spending, benefiting from rising home values and strong financial markets. Meanwhile, middle-income spending continues to lag inflation. This trend underscores the increasing importance of value-driven messaging in reaching today’s consumers.

As we enter Q4 early holiday promotions are already underway as retailers aim to capture demand ahead of peak season. Forecasts suggest 3% to 4% growth for the season, led by furniture, apparel, and electronics.

September 2025 Marketing Trends

Trend #1: Good News for Mailers: No USPS Price Increase in January 2026

The United States Postal Service has announced that there will be no price increase for Market Dominant products in January 2026. This decision offers welcome relief to businesses, nonprofits, and consumers who rely on mail services. Rates for First-Class Mail, Marketing Mail, Periodicals, and Package Services will remain unchanged through at least the first half of the year.

Postmaster General David Steiner emphasized the Postal Service’s commitment to pricing stability in the announcement. He noted that the move reflects a broader effort to support mailers and improve predictability across the mailing industry.

With rates holding steady in January, mailers can plan with confidence through mid-2026. This period of stability presents a valuable opportunity for businesses to refine mailing strategies and manage budgets more effectively.

However, USPS has signaled that a potential rate adjustment may occur in the summer of 2026. This would align with the proposed annual pricing schedule. Mailers should take advantage of the current rate freeze to prepare for future changes and maximize current efforts.

Between January 2021 and July 2025, USPS implemented eight rate increases. This announcement represents a significant shift in USPS’s pricing approach and is welcome news for customers.

Trend #2: 2025 Holiday Retail Outlook: Key Insights from PwC, Bain, Deloitte & Mastercard

As the 2025 holiday season begins, leading forecasts from PwC, Bain & Company, Deloitte, and the Mastercard Economics Institute (MEI) anticipate trends in spending, generational shifts, and a strong emphasis on value this year.

Overall Holiday Spending Forecasts

- Bain forecasts 4% year-over-year growth in US retail sales for November and December, totaling $975 billion, slightly below the 10-year average of 5.2%.

- Deloitte anticipates a 2.9% to 3.4% increase in total holiday sales, reflecting cautious optimism amid economic headwinds.

- Mastercard MEI predicts a 3.6% increase in US retail sales (excluding autos) from November 1 to December 24, with e-commerce growing 7.9% and in-store sales by 2.3%.

- PwC projects a 5% decline in average holiday spending, the first notable drop since 2020, driven by inflation, tariffs, and economic uncertainty. Gift spending is anticipated to decline 11%, while travel and entertainment remain stable.

Consumer Behavior & Demographic Trends

- Baby Boomers and Millennials are expected to maintain or slightly increase their spending, with households with children spending twice as much as those without.

- Gen Z is expected to reduce holiday spending by 23%, focusing on value, sustainability, and self-gifting. They increasingly rely on AI tools to discover deals and favor resale and upcycled products.

Online vs. In-store

- PwC reports 51% plan to shop online, while 53% will shop in-store, showing a balanced approach.

- Bain sees in-store sales gaining momentum, especially in clothing, general merchandise, and health/personal care, while non-store growth slows to 7%.

Trend #3: Using Postal Retargeting to Drive Black Friday / Cyber Monday Sales

Black Friday and Cyber Monday are prime opportunities for online sales, and savvy marketers are cutting through the noise with postal retargeting. Using behavioral data like abandoned carts and product views, combined with predictive modeling, retargeting with physical mail drives real-world conversions.

Why Postal Retargeting Works for BFCM

- Meet Customer Intent with Follow-Through: Shoppers are ready to buy, but distractions and decision fatigue can interrupt the process. A timely postcard or flyer can bring them back.

- Postcards Stand Out When Digital Channels are Crowded: While inboxes and social feeds are flooded with ads, physical mailboxes are quieter. This gives your message a better chance to be seen.

- Personal Engagement: Many consumers perceive direct mail as more personal and engaging. With variable printing, messages can be individually tailored or customized. Incorporating a holiday offer or promotional QR code makes it easy for recipients to act.

Tips for Success

- Target Smart: Focus on users who showed strong buying signals, like adding items to their cart or spending time on product pages.

- Act Quickly: Use automated platforms that can send mail within 24 to 48 hours of a site visit to stay relevant.

- Design for Impact: Incorporate bold visuals, limited-time offers, and clear calls to action that match your BFCM campaign.

Postal retargeting blends digital intent with physical engagement, helping brands boost conversions during some of the most competitive shopping days of the year.

Trend #4: Why User-Generated Content Is a Game-Changer for Fashion Brands

In today’s fast-paced fashion landscape, user-generated content (UGC) has become a vital tool for driving engagement, building trust, and increasing sales. For apparel brands, featuring real customers wearing and styling their products adds a layer of authenticity that traditional campaigns often lack.

Tuckernuck is a digitally native lifestyle brand known for its modern take on classic American style. At their recent Palm Beach pop-up, Tuckernuck used reminder ads to build anticipation and captured on-site UGC to boost both foot traffic and post-event visibility. This strategy boosted engagement and reinforced the brand’s community-driven identity.

Brands like ASOS and Free People have built entire ecosystems around UGC. These brands encourage customers to share their outfits using branded hashtags and dedicated platforms, turning everyday shoppers into brand advocates.

Best Practices for Apparel Brands Using UGC

- Launch branded hashtag campaigns to encourage organic sharing and build momentum

- Feature customer photos on product pages and across social media to enhance credibility

- Offer incentives such as discounts, giveaways, or reposts to motivate participation

- Use AI tools to moderate submissions and improve quality while maintaining authenticity

- Integrate UGC into paid media to extend reach and improve ad performance

In a world where consumers trust peers more than polished ads, UGC is essential. Brands like Tuckernuck show that a content-first strategy, powered by real voices, can fuel growth, deepen engagement, and build lasting loyalty.

Trend #5: Texting That Converts: SMS Strategies for DTC and Retail Brands

SMS marketing is a powerful channel for DTC and retail brands seeking to strengthen customer relationships and drive conversions. With open rates exceeding 90%, text messaging offers unmatched immediacy and visibility compared to email or social media.

For DTC brands, SMS allows for personalized communication at scale. It’s ideal for announcing product drops, sharing exclusive offers, or sending abandoned cart reminders. Retailers can use SMS to promote in-store events, flash sales, and loyalty rewards, creating urgency and a sense of exclusivity.

What Makes SMS Marketing Work?

Relevance and timing are key, effective SMS messages should be:

- Short and clear – Get to the point quickly.

- Value-focused – Provide something useful, such as a discount or early access.

- Tailored – Customize messages based on customer behavior, preferences, or location.

With segmentation and automation tools, brands can send targeted messages based on purchase history, engagement level, or geography. This ensures each message feels personal and timely.

Examples of Effective SMS Marketing

- Alo Yoga uses SMS to notify loyalty members about reward points and give early access to new product colors, driving urgency and repeat purchases.

- Nordstrom integrated SMS into its customer experience by allowing stylists to send personalized recommendations and enabling cardmembers to manage accounts via text.

- REI uses SMS to promote local events and exclusive member offers, enhancing community engagement and in-store visits.

Jump to Section

Marketing KPIs: September 2025 Trends by Industry

Marketing KPIs: September 2025 Trends by Company Revenue

$100M+ | $15M-$100M | $0-$15M

Marketing KPIs: September 2025 Trends by Industry

Apparel Industry

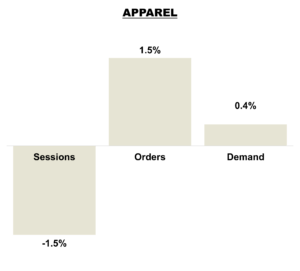

Many apparel brands experienced relatively flat performance compared to last September, marked by softer traffic but improved conversion rates.

Many apparel brands experienced relatively flat performance compared to last September, marked by softer traffic but improved conversion rates.

Sessions dipped -1.5% compared to last year. However, orders rose modestly +1.5%, while demand increased slightly +0.4%.

Brands with higher price points continued to see stable demand, while those with lower average order values faced greater challenges.

Home Brands

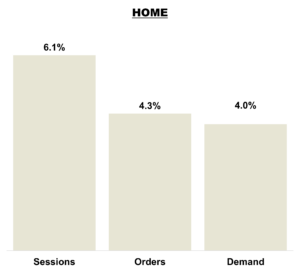

Home brands saw a strong rebound in September, building on August’s moderate gains. Sessions rose from +4.4% in August to +6.1%, indicating increased engagement and stronger traffic momentum.

Home brands saw a strong rebound in September, building on August’s moderate gains. Sessions rose from +4.4% in August to +6.1%, indicating increased engagement and stronger traffic momentum.

Orders improved to +4.3% (vs. +3.2% in August), while demand grew +4%, reflecting higher average order values (AOVs) and increased consumer spend.

This broad improvement in traffic, orders, and demand reflects renewed consumer confidence and stronger conversion rates as we enter Q4.

Outdoor Brands

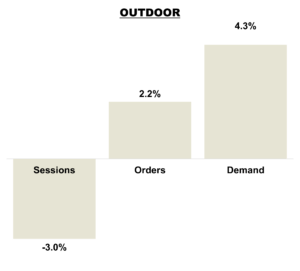

The outdoor industry showed a mixed recovery in September following August’s decline. Sessions declined from a +3.8% increase in August to a -3% decrease in September, signaling weaker site traffic and engagement.

The outdoor industry showed a mixed recovery in September following August’s decline. Sessions declined from a +3.8% increase in August to a -3% decrease in September, signaling weaker site traffic and engagement.

Despite lower traffic, orders grew 2.2% (vs. –3.5% in August), and demand increased +4.3%. This suggests improved conversion rates and higher-value purchases from engaged shoppers.

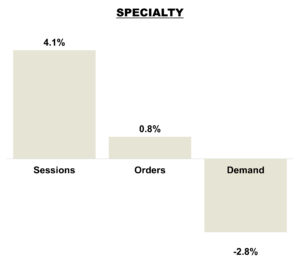

Specialty Retailers

Specialty brands showed signs of recovery in September after a weak August. Sessions rebounded from a -3% decline in August to a +4.1% increase, indicating renewed shopper interest and stronger site traffic.

Specialty brands showed signs of recovery in September after a weak August. Sessions rebounded from a -3% decline in August to a +4.1% increase, indicating renewed shopper interest and stronger site traffic.

However, orders improved modestly +0.8%, while demand decreased -2.8%.

The contrast between stronger traffic, limited order growth, and declining demand highlights ongoing challenges for specialty brands heading into Q4.

Marketing KPIs: September 2025 Trends by Company Revenue

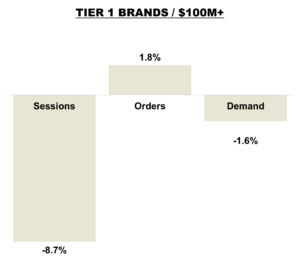

Tier 1 Brands

Tier 1 brands experienced a slowdown in September following August’s mixed performance. Sessions declined further from –1.1% in August to –8.7%, signaling reduced shopper engagement and weaker site traffic.

Tier 1 brands experienced a slowdown in September following August’s mixed performance. Sessions declined further from –1.1% in August to –8.7%, signaling reduced shopper engagement and weaker site traffic.

Orders shifted from strong growth (+8.9%) to modest increase +1.8%, while demand dropped from +4.8% to -1.6%.

Overall, September showed weaker engagement, though conversion rates suggest continued resilience among higher-value consumers heading into Q4.

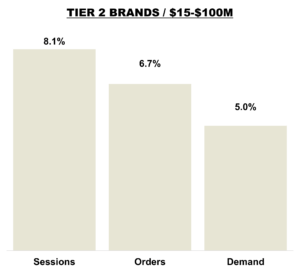

Tier 2 Brands

Tier 2 brands saw positive results in September. Sessions increased +8.1% reflecting continued traffic growth and healthy shopper engagement.

Tier 2 brands saw positive results in September. Sessions increased +8.1% reflecting continued traffic growth and healthy shopper engagement.

Orders showed an improvement from last month, +6.7% (vs. +3% in August), and demand rose to +5% from +0.6%, signaling improved conversion and slightly stronger consumer spend.

The consistent gains across traffic, orders, and demand point to a stable growth trend, suggesting healthier mid-tier performance heading into Q4.

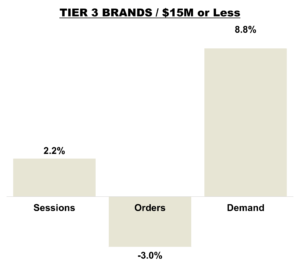

Tier 3 Brands

Tier 3 brands showed a solid rebound in September after softer August results. Sessions rose from –0.7% in August to +2.2%, reflecting renewed traffic growth and stronger engagement.

Tier 3 brands showed a solid rebound in September after softer August results. Sessions rose from –0.7% in August to +2.2%, reflecting renewed traffic growth and stronger engagement.

Orders remained in decline –3% (compared to –3.2% in August), but demand improved to +8.8% from +1.3%, indicating higher-value purchases among active shoppers.

Despite flat orders, the combination of rising traffic and stronger demand suggests improving consumer interest and spend potential heading into Q4.