We compiled these trends from over 100 brands, comparing year-over-year data for the date range December 1, 2025, to December 31, 2025.

December 2025: Record Holiday Spending

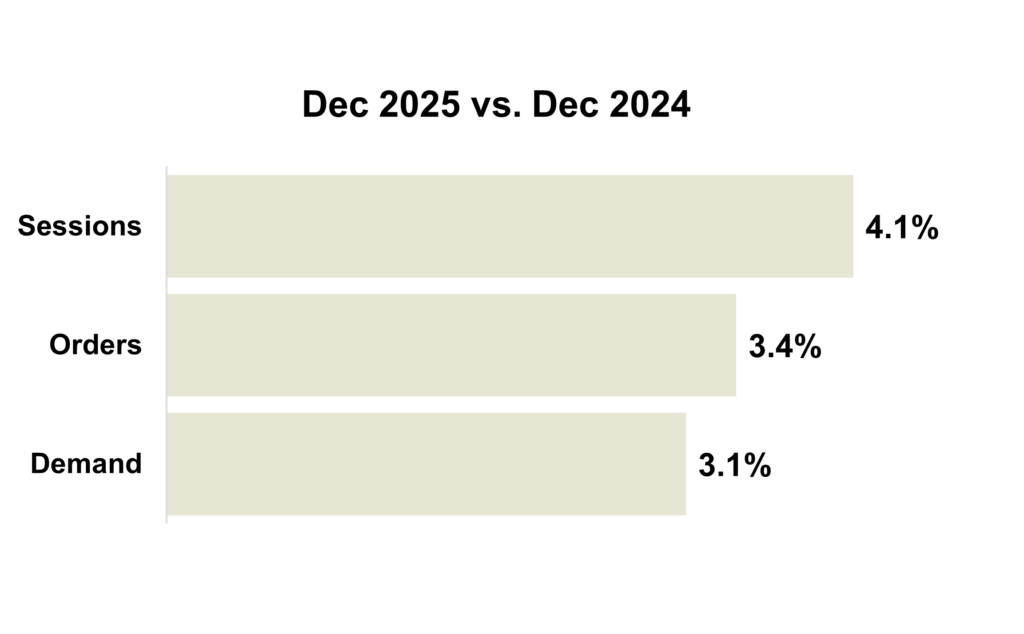

December 2025 ended with strong momentum. Sessions increased 4.1%, orders grew 3.4%, and demand rose 3.1%. Holiday sales set new records with growth between 3.9 and 4.2 % compared to 2024.

The 2025 holiday season surpassed one trillion dollars in total sales. Conversion improved after Cyber Week, and momentum remained positive through year end. Buy Online, Pick Up In Store activity increased sharply in the final week before Christmas, while returns were modestly lower for many brands.

Consumer spending remains active but increasingly disciplined. Inflation pressures and labor market uncertainty continue to drive value‑oriented behavior. According to McKinsey, three out of four consumers traded down in at least one category in 2025, signaling a more pragmatic approach to spending.

Looking ahead to early 2026, spending is expected to remain cautious but stable. Elevated essential costs may limit discretionary growth, but strong digital adoption and continued value‑driven purchasing should support moderate retail momentum.

December 2025 Marketing Trends

Trend #1: Holiday 2025 Recap: A Strong Finish with Record Growth

The 2025 holiday season ended on a high note, with total retail sales surpassing one trillion dollars for the first time. The National Retail Federation reported sales growth of approximately 4.1% from November 1 through December 31, landing near the top of its forecast range.

Early reporting from payment networks aligned with this trend. Mastercard SpendingPulse showed 3.9% growth through December 21, while Visa reported 4.2% growth. Both noted that ecommerce continued to outpace brick‑and‑mortar stores.

Online spending reached a record 257.8 billion dollars, up 6.8% year over year, according to Adobe. Twenty‑five days exceeded four billion dollars in online sales. Cyber Week generated 44.2 billion dollars, with Cyber Monday and Black Friday producing 14.25 billion and 11.8 billion dollars respectively. Mobile devices accounted for 56.4% of online transactions.

Omnichannel behavior accelerated late in the season. Salesforce reported that Buy Online, Pick Up In Store accounted for nearly one in five online orders during the holidays. In the final five days before Christmas, that figure rose to roughly one in three orders, underscoring the importance of inventory visibility and clear fulfillment cutoffs.

Returns declined slightly overall, down 1.2% for the season, although post‑Christmas week returns increased 4.7%. The NRF estimates that 15.8% of total sales and 19.3% of online sales were returned in 2025.

Trend #2: Super Bowl 2026 Advertising Trends Marketers Should Watch

As Super Bowl LX approaches, advertising is expected to strike a new balance between creativity, technology, and trust. Brands are preparing for a moment where entertainment must also feel emotionally relevant, and where innovation supports deeper connections with viewers.

Many advertisers are leaning into lighter, emotionally warm storytelling that emphasizes joy, nostalgia, and human connection. Viewers are not tuning in for heavy messages. They want to be entertained. Budweiser is a clear example, with a heritage‑driven campaign that celebrates its place in American culture through the return of the iconic Clydesdale horses.

Trust‑driven storytelling is emerging as another key theme. Brands are positioning themselves as supporters rather than sellers, reflecting a broader shift toward sincerity and long‑term relationship building.

Interactive ad formats are also gaining traction. Brands are expected to test scannable or tappable calls to action that unlock offers, content, or experiences during the broadcast.

Together, these trends point to a Super Bowl environment where emotional resonance, trust, and interactivity work in tandem. Brands that successfully blend all three are best positioned to stand out on the biggest advertising stage of the year.

Trend #3: Smarter Return Strategies For Retailers

The NRF estimates nearly 20 percent of online orders were returned in 2025. Returns are costly, but smarter policies and processes can reduce volume, protect margins, and improve customer experience.

Tips for Managing Returns

- Prevent returns at the source: Expand fit and sizing tools, enrich product detail pages, and provide post‑purchase “how to use” content. AI‑guided selection tools can help shoppers choose the right product the first time.

- Modernize policies to balance CX and Cost: Offer free, in‑person, box‑free drop‑offs where condition can be verified. Provide free exchanges or instant credit. Consider mail‑in fees for low‑margin items and clearly display policies before purchase.

- Recover value faster: Shorten return‑to‑resale cycle times to preserve value. Best Buy uses structured open‑box and refurb grading to return electronics to inventory efficiently. Patagonia refurbishes and resells returned items through its Worn Wear program, recovering margin while reducing waste.

- Targeted fraud controls: Use risk‑based screening and in‑person verification for high‑risk returns. Track reason codes and SKU patterns to identify wardrobing and box‑swap behavior.

- Shift customer behavior upstream: Brands such as Levi’s and Lululemon offer instant credits for trade‑ins, encouraging exchanges and store drop‑offs that lower return costs and increase repurchase rates.

Trend #4: Extending Digital Intent with Direct Mail

Intent‑based postal retargeting allows brands to reach customers and prospects who have already shown interest in their products or services. By extending digital intent signals into direct mail, brands can reinforce consideration and drive higher conversion rates.

Benefits of Intent-Based Postal Retargeting

- Increased conversions and revenue

- Improved brand awareness

- Higher ROI

- More targeted messaging

How Does Intent-Based Postal Retargeting Work?

- Identify your target audience.

- Collect data on their online behavior.

- Use this data to create a mailing list of potential customers.

- Send them a direct mail campaign with personalized messaging.

Get Started with Intent-Based Postal Retargeting

If you’re interested in learning more about intent-based postal retargeting, let us know. We can help you create a custom campaign that will reach your target audience and drive results.

Jump to Section

Marketing KPIs: December 2025 Trends by Industry

Marketing KPIs: December 2025 Trends by Company Revenue

$100M+ | $15M-$100M | $0-$15M

Marketing KPIs: December 2025 Trends by Industry

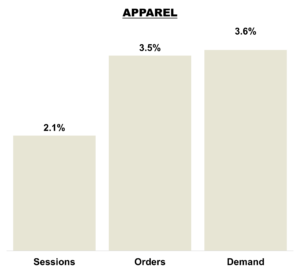

Apparel Industry

Sessions rose 2.1%, while orders grew 3.5%, indicating modestly improved conversion efficiency versus November. Demand increased 3.6%, roughly in line with order growth, as average order values normalized following November’s elevated holiday baskets. Overall, YoY momentum remained positive, with efficiency gains offsetting softer traffic and AOV in the post–Cyber Week period.

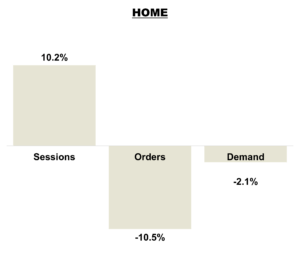

Home Brands

Sessions grew 10.2%, maintaining positive engagement but slowing sharply from November’s holiday surge. Orders declined 10.5%, signaling a significant drop in conversion efficiency, while demand fell 2.1%, reversing last month’s strong revenue gains. This trend reflects post-holiday normalization and softer purchase intent, underscoring the need for targeted clearance promotions and retention strategies as we transition into Q1.

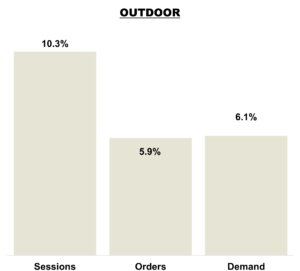

Outdoor Brands

Sessions grew 10.3%, slightly below November’s pace but still reflecting strong engagement. Orders held steady at 5.9%, signaling stable conversion performance. Demand increased 6.1%, moderating from last month as average order values normalized post-holiday. Overall, the Outdoor category sustained positive momentum into December, though revenue efficiency softened, highlighting the need for clearance and retention strategies heading into Q1.

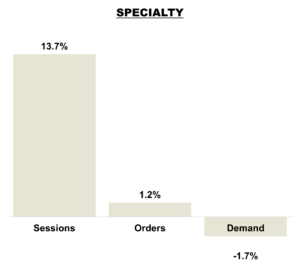

Specialty Retailers

Sessions remained strong at 16%, reflecting sustained consumer interest. Orders improved slightly to 0.9%, reversing October’s decline but still trailing behind traffic growth. Demand grew just 0.9%, signaling stabilization after last month’s sharp drop but highlighting ongoing challenges in conversion and revenue efficiency. While engagement is healthy, the Specialty category needs targeted strategies to better capitalize on high traffic and drive stronger holiday performance.

Marketing KPIs: December 2025 Trends by Company Revenue

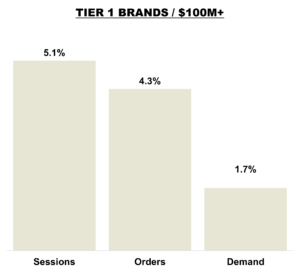

Tier 1 Brands

Sessions grew 5.1%, largely in line with November. Orders rose 4.3%, trailing traffic and indicating softer conversion efficiency versus last month. Demand increased 1.7%, reflecting further compression in average order values amid promotional activity. Overall, Tier 1 brands sustained positive YoY momentum, but December showed cooler growth and revenue efficiency, underscoring the need to shore up conversion and protect AOV as we move into Q1.

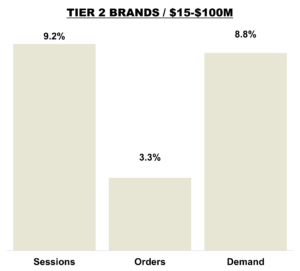

Tier 2 Brands

Sessions rose 9.2%, moderating from November’s pace. Orders increased 3.3%, trailing traffic and signaling softer conversion efficiency. Demand grew 8.8%, still outpacing orders but below November’s elevated AOV, reflecting normalization after peak holiday merchandising. Overall, Tier 2 brands maintained positive YoY momentum, though December showed cooler growth and efficiency, underscoring the need to shore up conversion and protect AOV heading into Q1.

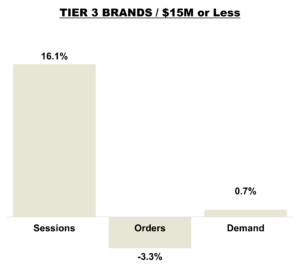

Tier 3 Brands

Sessions climbed 16.1%, accelerating from November and reflecting strong shopper interest. Orders declined 3.3%, widening the gap to traffic and signaling continued conversion challenges. Demand grew 0.7%, down sharply from November as average order values compressed amid heavier promotional activity. Overall, Tier 3 brands saw increased browsing but weaker monetization, highlighting the need to bolster conversion and protect AOV heading into Q1.