We compiled these trends from over 100 brands, comparing year-over-year data for the date range January 1, 2026, to January 31, 2026.

January 2026: Stable Consumers, Smarter Operations

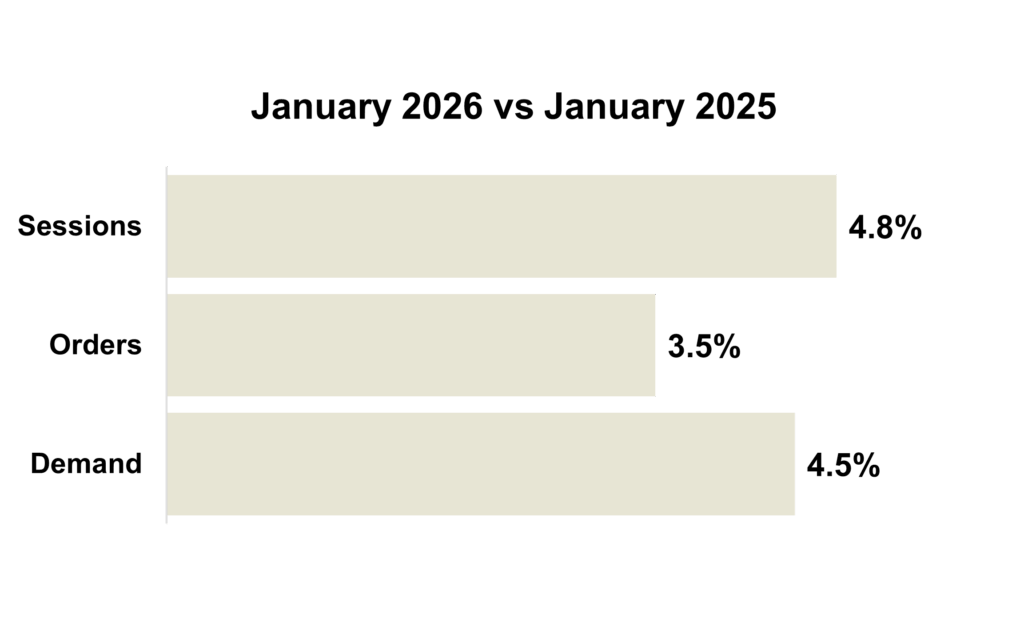

January delivered a steady start to the year. Sessions rose 4.8%, orders were up 3.5%, and demand grew 4.5% compared to last year. Apparel growth slowed after the holidays. Outdoor categories saw lower average order values. Home categories showed an early rebound, and many specialty brands outperformed the usual post‑holiday slowdown.

Broader economic signals were mixed. The Saks bankruptcy underscored the challenges facing the traditional department store model. Winter storms reduced store traffic and shifted more buying activity online.

Consumers remain financially stable. Deloitte’s financial well‑being index ended 2025 up three points as inflation eased. More shoppers are also leaning toward value. Four in ten Americans now show deal‑oriented or cost‑conscious behaviors. Consumers are still willing to spend, but they want clear proof of value and an easy way to find it.

As Q1 continues, retailers are tightening their approach to financial management. Many are putting greater focus on margin protection, inventory productivity, and cost control. Strong execution at the store and digital levels is becoming more important as demand patterns remain uneven and pressure on profitability increases.

These trends suggest early 2026 will be shaped by careful consumers and disciplined retailers. The brands that will outperform are the ones that deliver strong value, manage costs well, and respond quickly to shifts in demand.

January 2026 Marketing Trends

Trend #1: Saks Bankruptcy Puts Pressure On Brands

Saks Global, which owns Saks Fifth Avenue, Neiman Marcus, and Bergdorf Goodman, filed for Chapter 11 bankruptcy on January 13, 2026, after missing a $100 million interest payment tied to its debt financed acquisition of Neiman Marcus. The company secured roughly $1.75 billion in debtor in possession financing to maintain operations during restructuring and is exiting most of its off-price business, closing the majority of Saks OFF 5TH locations and all Last Call stores.

While the company owes hundreds of millions to suppliers, the impact varies by brand scale. Large luxury groups such as Chanel, Kering, and LVMH are among the largest creditors and are expected to be protected as critical vendors.

Independent and midsize brands face a far more challenging outlook. Many depend on Saks and Neiman Marcus for up to half of their wholesale sales, exposing them to delayed payments, reduced recoveries, and abrupt loss of distribution. Unlike larger groups, these brands have limited leverage in bankruptcy proceedings and fewer options to replace lost volume.

Over the longer term, the filing underscores a broader shift in luxury retail toward tighter assortments and a smaller group of established labels. As department stores become a less dependable growth engine, emerging brands face growing pressure to diversify beyond wholesale.

Trend #2: What Marketers Can Learn From Hunting Season

Seasonality is one of the most underused advantages in marketing. Few categories illustrate its power more clearly than hunting.

Hunting seasons are not simple promotional windows. They are predictable, high‑intent periods shaped by regulation, geography, and tradition. Preparation begins months before opening day, creating a long runway for brands that plan ahead.

Well before the season starts, consumers are already mentally and emotionally invested. Brands that align messaging to preparation and anticipation consistently outperform those relying on short‑term discounts or late‑stage promotions.

As the season approaches, hunters upgrade equipment and replenish consumables. Lifecycle‑based activation during this phase drives stronger conversion and loyalty than in‑season prospecting alone.

When opening day arrives, it is more than just the start of a season. For many hunters it is a ritual with deep traditions, and personal meaning. Brands that recognize and speak to these moments show authenticity and reinforce loyalty.

Once the season begins, the opportunity shifts to retention. Consumables require ongoing replenishment, creating repeated moments of relevance for brands that remain present throughout the season.

When the season ends, engagement does not. Gear is cleaned, repaired, and upgraded. Stories are shared, lessons are learned, and planning for the next season begins almost immediately.

Hunting illustrates the full power of end‑to‑end seasonal planning. Demand is predictable, excitement is sustained, and loyalty is built through relevance at every stage. Marketers who design for the entire season stop competing on urgency and start building durable growth.

Trend #3: What a Warsh‑Led Fed Means for Retail Growth in 2026

President Trump’s nomination of former Federal Reserve governor Kevin Warsh to succeed Jerome Powell marks a meaningful shift in monetary leadership as the Fed enters the second half of 2026. While Warsh is not expected to radically change rate policy overnight, his stated openness to near‑term rate cuts alongside a firm stance on inflation discipline has clear implications for retail and direct‑to‑consumer brands.

Warsh is widely seen as more receptive to easing rates than his predecessor, though far from embracing the ultra‑low‑rate environment that fueled DTC growth earlier in the decade. If confirmed, marketers should expect incremental improvement in borrowing conditions rather than broad liquidity expansion. This favors brands with strong unit economics and disciplined acquisition strategies over those reliant on cheap capital.

Even small reductions in benchmark rates directly affect credit cards, private‑label financing, and BNPL adoption. For retailers, this can translate into higher conversion and stronger average order values, particularly in discretionary and high‑consideration categories. These shifts support demand without requiring deeper discounting.

Stabilizing macro sentiment under a Warsh Fed could draw more ad dollars back into performance media. As budgets rebound, marketers should expect renewed upward pressure on digital CPMs and CACs. In this environment, channels that deliver provable incrementality and durable reach regain strategic importance.

As acquisition costs rise and capital remains selective, marketers will be pushed to justify spend with measurable outcomes. Direct mail benefits from this shift: it reaches households already under credit pressure, avoids auction‑based inflation, and can be modeled for true incremental lift. In a market where efficiency matters as much as growth, offline channels with verifiable performance become a stabilizing force in the media mix.

A Warsh-led Fed signals cautious stimulus paired with renewed accountability. For retail and DTC brands, success in 2026 will hinge less on macro tailwinds and more on media strategies that deliver predictable, incremental revenue. Channels that combine reach, attribution, and resilience to digital volatility are positioned to win.

Trend #4: Valentine’s Day Gifting Is About Psychology, Not Just Romance

Valentine’s Day has long been framed as a holiday for romantic partners, but consumer behavior tells a broader story. According to research highlighted by Yale School of Management’s Center for Customer Insights, Valentine’s spending now extends well beyond couples to include friends, coworkers, pets, and even self-gifting. Valentine’s Day is no longer about romance alone and more about how people use gifts to signal care, connection, and identity across different relationships.

One of the most important insights is how gift preferences change depending on the recipient. When buying for others, consumers gravitate toward best-selling and popular items. These choices reduce the perceived risk of giving the “wrong” gift and offer reassurance through social proof. In contrast, self gifters tend to prefer limited-edition or distinctive products that emphasize uniqueness and indulgence. The same shopper may want safety for others and self-expression for themselves, creating clear opportunities for differentiated product positioning.

The research also supports that the meaning behind a gift often outweighs its price. Gifts serve as social signals, particularly in newer or less certain relationships, where thoughtfulness can communicate intention, effort, and emotional investment. Even last-minute purchases are frequently driven by high intent rather than apathy, making convenience and clarity critical rather than discounting alone.

For brands, the takeaway is straightforward. Winning Valentine’s Day requires aligning messaging, assortment, and timing with the psychology of gifting. Brands that recognize relationship context and emotional motivation will be better positioned to capture both relevance and incremental demand.

Jump to Section

Marketing KPIs: January 2026 Trends by Industry

Marketing KPIs: January 2026 Trends by Company Revenue

$100M+ | $15M-$100M | $0-$15M

Marketing KPIs: January 2026 Trends by Industry

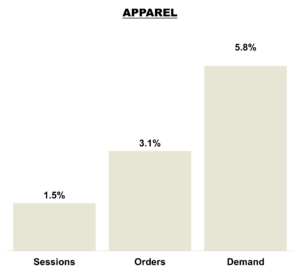

Apparel Industry

Sessions increased 1.5% year-over-year, while orders rose 3.1%, indicating improved conversion efficiency as growth in purchases outpaced traffic. Revenue climbed 5.8%, exceeding order growth and suggesting stronger average order values and/or a favorable product mix. Overall, January performance reflects healthy demand and better monetization per visitor, positioning the Apparel/Fashion category well as it transitions into early-year shopping patterns.

Sessions increased 1.5% year-over-year, while orders rose 3.1%, indicating improved conversion efficiency as growth in purchases outpaced traffic. Revenue climbed 5.8%, exceeding order growth and suggesting stronger average order values and/or a favorable product mix. Overall, January performance reflects healthy demand and better monetization per visitor, positioning the Apparel/Fashion category well as it transitions into early-year shopping patterns.

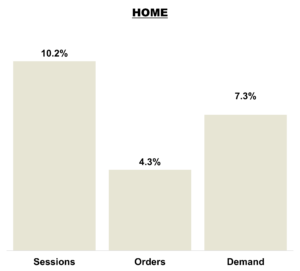

Home Brands

Sessions increased 10.2% year-over-year, reflecting strong consumer interest in the Home category. Orders rose 4.3%, but trailed traffic growth, suggesting conversion efficiency softened as increased visits did not translate proportionally into purchases. Revenue grew 7.3%, outpacing orders and indicating stronger average order values and/or a more favorable product mix. Overall, demand remains healthy, but improving conversion and traffic quality will be key to fully capitalize on elevated engagement.

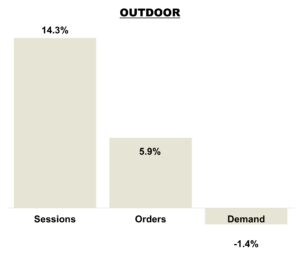

Outdoor Brands

Sessions increased 14.3% year-over-year, reflecting strong consumer interest in the Outdoor category. Orders grew 5.9% but trailed traffic, indicating softer conversion efficiency as increased site visits did not translate proportionally into purchases. Revenue declined 1.4% despite higher order volume, suggesting meaningful compression in average order values driven by promotional activity and/or a shift toward lower-priced items. Overall, engagement is strong, but improving conversion and protecting AOV will be key to translating elevated demand into profitable growth.

Specialty Retailers

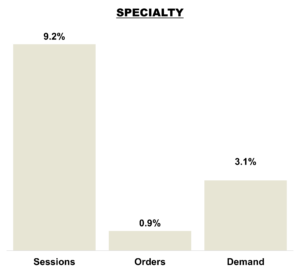

Sessions increased 9.2% year-over-year, reflecting strong shopper interest in Specialty. Orders rose 0.9%, trailing traffic growth and indicating softer conversion efficiency. Revenue grew 3.1%, outpacing orders and suggesting higher average order values and a healthier mix. Overall, engagement is strong, but improving conversion and traffic quality will be key to fully capitalize on increased demand.

Sessions increased 9.2% year-over-year, reflecting strong shopper interest in Specialty. Orders rose 0.9%, trailing traffic growth and indicating softer conversion efficiency. Revenue grew 3.1%, outpacing orders and suggesting higher average order values and a healthier mix. Overall, engagement is strong, but improving conversion and traffic quality will be key to fully capitalize on increased demand.

Marketing KPIs: January 2026 Trends by Company Revenue

Tier 1 Brands

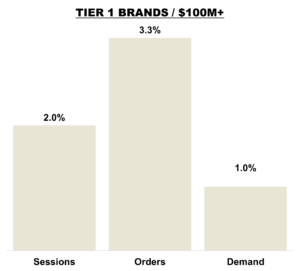

Sessions increased 2.0% year-over-year, while orders rose 3.3%, signaling improved conversion efficiency for Tier 1 brands. Revenue grew 1.0%, lagging order growth and indicating average order values softened, likely due to promotional activity or a shift toward lower-priced purchases. Overall, Tier 1 brands maintained positive momentum, but protecting AOV and revenue per visit will be key moving forward.

Sessions increased 2.0% year-over-year, while orders rose 3.3%, signaling improved conversion efficiency for Tier 1 brands. Revenue grew 1.0%, lagging order growth and indicating average order values softened, likely due to promotional activity or a shift toward lower-priced purchases. Overall, Tier 1 brands maintained positive momentum, but protecting AOV and revenue per visit will be key moving forward.

Tier 2 Brands

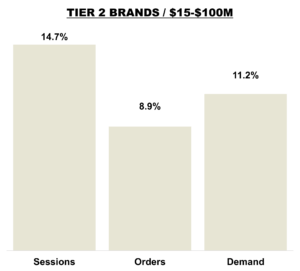

Sessions increased 14.7% year-over-year, reflecting strong top-of-funnel momentum for Tier 2 brands. Orders rose 8.9%, trailing traffic growth and indicating a continued opportunity to improve conversion efficiency. Revenue grew 11.2%, outpacing orders and suggesting stronger average order values and a favorable product mix. Overall, Tier 2 brands delivered robust growth in January, with healthy monetization gains despite conversion still lagging elevated traffic.

Sessions increased 14.7% year-over-year, reflecting strong top-of-funnel momentum for Tier 2 brands. Orders rose 8.9%, trailing traffic growth and indicating a continued opportunity to improve conversion efficiency. Revenue grew 11.2%, outpacing orders and suggesting stronger average order values and a favorable product mix. Overall, Tier 2 brands delivered robust growth in January, with healthy monetization gains despite conversion still lagging elevated traffic.

Tier 3 Brands

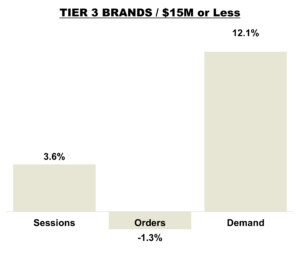

Sessions increased 3.6% year-over-year for Tier 3 brands, while orders declined 1.3%, indicating continued conversion challenges. However, revenue surged 12.1%, significantly outpacing both traffic and orders and suggesting a strong lift in average order value and/or product mix. Overall, smaller brands are monetizing visits more effectively, but improving conversion will be critical to translate steady demand into sustainable volume growth.