We compiled these trends from over 100 brands, comparing year-over-year data for the date range November 1, 2025, to November 30, 2025.

November 2025: Holiday Spending Continues, Strong Cyber Week

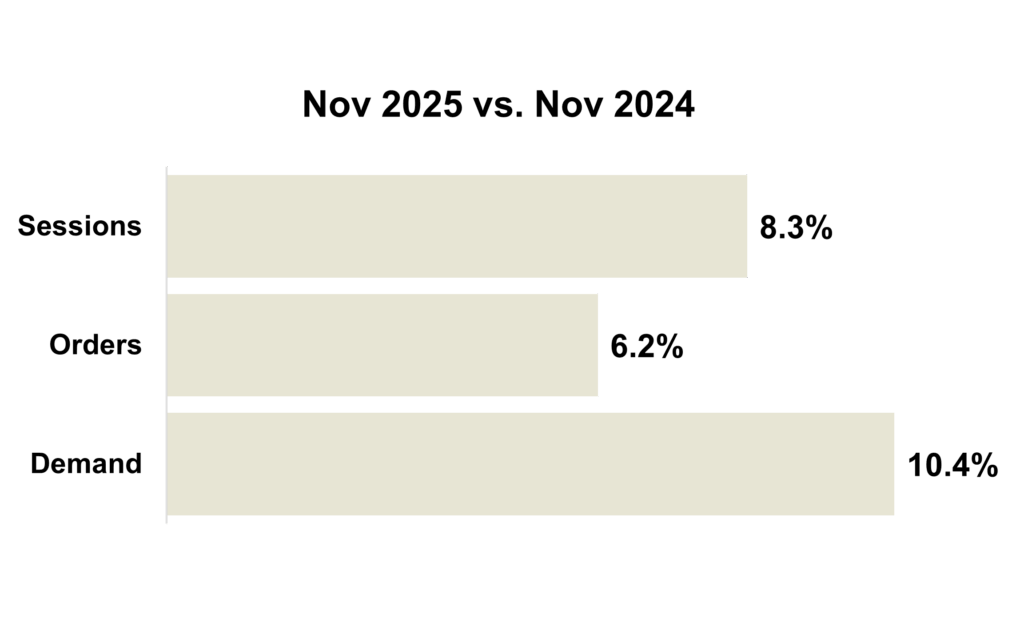

Retailers delivered strong November results. Sessions rose 8.3%, orders 6.2%, and demand 10.4% year-over-year. Despite surveys signaling cutbacks, consumer spending proved resilient.

Cyber Week spending surged despite economic headwinds and a three-year low in consumer confidence. Black Friday online sales reached $11.8 billion, up 9%, while Cyber Monday hit $14.25 billion. Mobile accounted for more than half of transactions.

Brands are emphasizing value, and flexible payment options. Average discounts ranged from 28% to 38%, though inflation tempered real savings. An increasing number of shoppers are also turning to flexible payment options. 43% of shoppers plan to use Buy Now, Pay Later (BNPL) for holiday purchases, up from 20% last year.

As the holiday season winds down, marketers are in the final push to capture last-minute demand. Nearly 89% of U.S. consumers plan to shop in the final two weeks before December 25, and Super Saturday is expected to attract 76% of shoppers.

November 2025 Marketing Trends

Trend #1: Cyber Week 2025 Recap: What Marketers Need to Know

Cyber Week 2025 exceeded expectations. Online engagement rose nearly 10% year-over-year, with mobile driving 79% of traffic. E-commerce sales outpaced retail, and despite early promotions starting in October, Black Friday remained dominant with a 7% sales increase; Cyber Monday grew 2%.

Apparel sessions rose 7.7%, but steep discounts (avg. 37%) lowered AOVs. Home brands led growth with higher spending per order and strong bundle uptake. Outdoor traffic jumped 14.3%, though demand softened post-pandemic. Specialty brands faced flat conversions and margin pressure.

As the holiday season closes, marketers should reflect on these trends to shape 2026 strategies. Mobile optimization remains essential, and early, targeted promotions can capture demand without sacrificing margins. Bundling and premium offers outperform blanket discounts, while monitoring discount depth is critical for apparel and specialty segments. These insights provide a roadmap for sustaining profitability in an increasingly promotional environment.

Trend #2: Holiday Sales Countdown: How to Win the Final Shopping Surge

The final holiday stretch offers a critical window for last-minute demand. Nearly 89% of U.S. consumers plan to shop in the final two weeks before December 25, with Super Saturday expected to draw 76% of shoppers. In-store traffic remains strong, as 88% intend to visit physical stores and younger demographics lead shopping center visits.

Economic pressures are shaping behavior. 41% of Americans expect to spend less due to high prices, and global consumers report rising costs and reduced savings. Traditional holiday advertising is losing influence, making personalized, value-driven messaging essential.

Consumer behavior is also shifting. Over half of shoppers will use AI for gift ideas; Gen Z adoption is 73%. AI-driven referrals surged 750% year-over-year during Cyber Week. Mobile commerce leads the charge, accounting for 57.5% of Cyber Monday sales, while Buy Now Pay Later transactions exceeded $1 billion, up 31% from last year.

Last-minute demand offers strong potential in the final days of the holiday season. Marketers should focus on convenience with same-day pickup and clear shipping cutoffs, emphasize value beyond discounts, and integrate digital with in-store experiences. Following with post-holiday engagement through loyalty programs or customer journey programs, brands can sustain holiday momentum into 2026.

Trend #3: From Cart to Checkout: Why BNPL Is the Secret Weapon for Holiday Growth

Buy Now, Pay Later (BNPL) is transforming holiday shopping in 2025, driving record adoption and reshaping consumer behavior. Nearly 43% of shoppers report using or planning to use BNPL for holiday purchases, up from 20% in 2023. Once considered a niche payment option, BNPL is now mainstream, helping consumers manage budgets amid inflation and rising gift costs.

Holiday 2025 BNPL Highlights

- Record Spend: BNPL is projected to hit $20.2 billion this holiday season (Nov–Dec), an 11% increase over 2024. Cyber Monday alone saw $1.03 billion in BNPL transactions, about 7% of online sales.

- Growth Trend: BNPL has driven $10.1 billion in online sales so far this season, up 9% year-over-year.

- Conversion Impact: Over 50% of consumers say they’re more likely to buy when BNPL is offered, boosting basket sizes and reducing cart abandonment.

- Demographic Drivers: Millennials and Gen Z lead adoption, with 42% using BNPL compared to 21% of other generations.

Key Retailer Benefits

- Increased Sales and Basket Sizes: Flexible installments encourage larger purchases and higher average order values.

- Appeal to Younger Consumers: BNPL aligns with digital-first habits and cost-conscious shopping among Millennials and Gen Z.

- Improved Conversion Rates: Reduces friction at checkout, helping retailers capture more sales during peak season.

Holiday budgets are tight, but BNPL is giving shoppers breathing room. Flexile payment options are making it easier to spread out payments without relying on credit cards, turning BNPL into a go-to tool for managing costs while still enjoying the season.

Trend #4: K-Shaped Recovery: What Retailers Need to Know

The term “K-shaped recovery” describes an economic rebound that is uneven. Instead of all sectors improving at the same pace, some recover quickly while others continue to struggle. Picture the letter K: the upward stroke represents thriving sectors, the downward stroke those falling behind.

High-income shoppers are driving premium purchases and fueling luxury and niche direct-to-consumer brands. Lower-income households, pressured by inflation, are cutting discretionary spending. Subscription-based models and AI-driven personalization are thriving, while traditional retailers reliant on foot traffic face growing pressure.

Retailers have become increasingly dependent on spending by the wealthiest households. According to Moody’s, the top 10% of earners now account for roughly 40–45% of total U.S. consumer spending. The top 1% drives about 15–20% of retail sales, especially in categories like luxury goods, travel, and high-end services.

For retailers and direct-to-consumer brands, the message is clear. In a K-shaped economy, growth is not uniform. Brands that anticipate uneven demand and adapt quickly will be best positioned to succeed in today’s economy.

Jump to Section

Marketing KPIs: November 2025 Trends by Industry

Marketing KPIs: November 2025 Trends by Company Revenue

$100M+ | $15M-$100M | $0-$15M

Marketing KPIs: November 2025 Trends by Industry

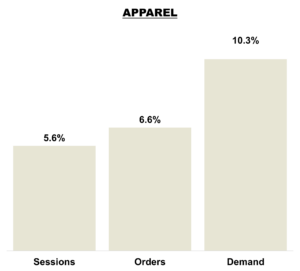

Apparel Industry

Sessions rose 5.6%, while orders surged 6.6%, reflecting stronger conversion efficiency compared to October. Demand grew 10.3%, continuing to outpace traffic and orders, though at a slightly slower rate than last month. This trend suggests consumers remain highly engaged, with seasonal promotions driving incremental volume even as average order values stabilize. Overall, apparel demand remains healthy, and momentum is strong heading into the holiday season.

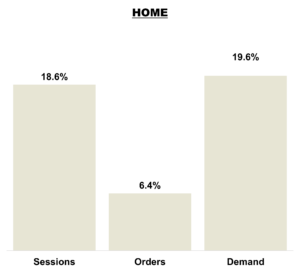

Home Brands

Sessions surged 18.6%, reflecting a significant increase in consumer interest during the holiday season. Despite this traffic spike, order growth held steady at 6.4%, suggesting conversion efficiency remains a challenge. Demand accelerated to 19.6%, outpacing both traffic and orders, driven by higher average order values and strong spending on home products. Overall, momentum is robust, but optimizing conversion will be key to fully leverage elevated traffic levels.

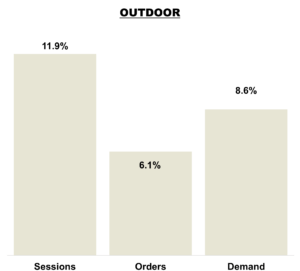

Outdoor Brands

Sessions surged 11.9%, marking a sharp increase in consumer engagement during the holiday season. Orders rebounded to 6.1%, reversing October’s flat trend and signaling improved conversion. Demand grew 8.6%, though at a slower pace than last month, indicating a shift toward lower-priced or promotional items compared to October’s premium-driven growth. Overall, the Outdoor category shows strong traffic momentum and healthier purchase activity, positioning well for continued holiday performance.

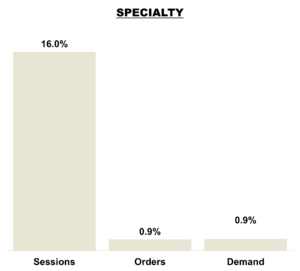

Specialty Retailers

Sessions remained strong at 16%, reflecting sustained consumer interest. Orders improved slightly to 0.9%, reversing October’s decline but still trailing behind traffic growth. Demand grew just 0.9%, signaling stabilization after last month’s sharp drop but highlighting ongoing challenges in conversion and revenue efficiency. While engagement is healthy, the Specialty category needs targeted strategies to better capitalize on high traffic and drive stronger holiday performance.

Marketing KPIs: November 2025 Trends by Company Revenue

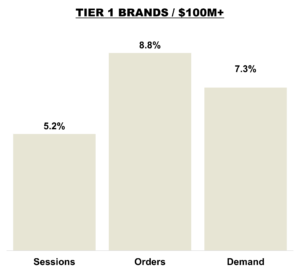

Tier 1 Brands

Sessions rebounded 5.2%, reversing October’s decline and signaling stronger holiday engagement. Orders surged 8.8%, marking a significant improvement in conversion efficiency. Demand grew 7.3%, slightly below last month’s pace, suggesting average order values normalized amid promotional activity. Overall, Tier 1 brands demonstrated strong traffic and conversion gains, reinforcing brand strength and positioning for continued holiday success.

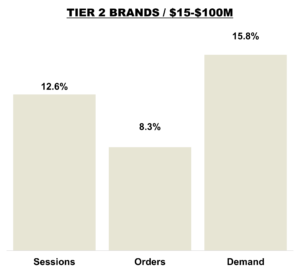

Tier 2 Brands

Sessions grew 12.6%, maintaining strong engagement despite a slight slowdown from October. Orders held steady at 8.3%, reflecting consistent conversion performance. Demand surged 15.8%, significantly outpacing traffic and orders, driven by higher average order values and effective holiday merchandising. Overall, Tier 2 brands show robust momentum and strong revenue efficiency heading into peak season.

Tier 3 Brands

Sessions grew 11.1%, maintaining strong engagement. Orders declined 3.2%, an improvement from October but still signaling conversion challenges. Demand rebounded to 7.2%, driven by higher average order values and effective holiday merchandising. While revenue recovery is encouraging, smaller brands must continue refining targeting and on-site experience to better translate traffic into sales.