We compiled these trends from over 100 brands, comparing year-over-year data for the date range October 1, 2025, to October 31, 2025.

October 2025: Q4 Starts Strong, Confidence Slips

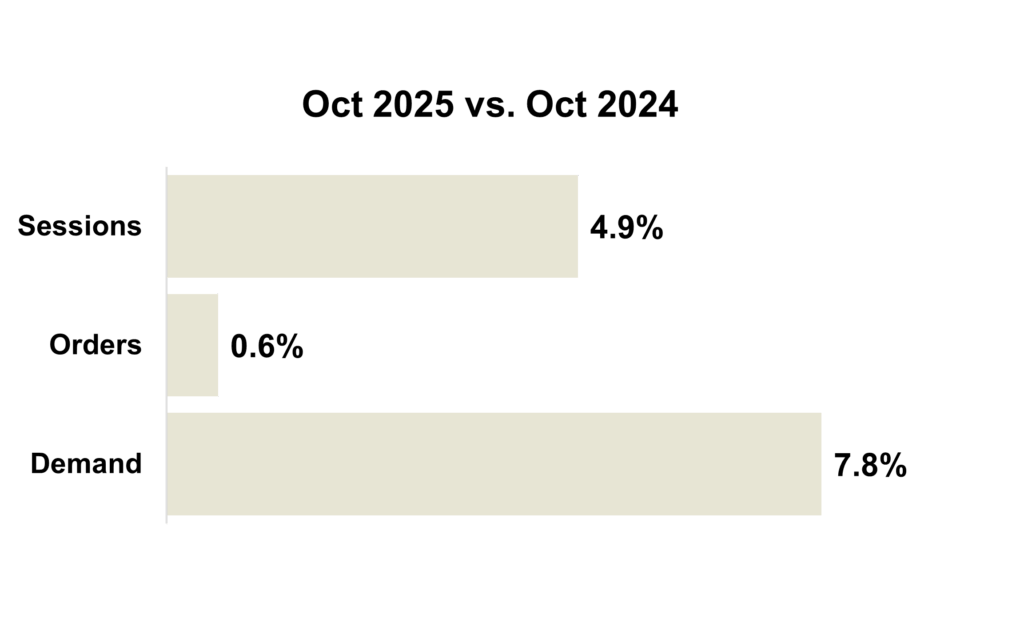

Q4 started strong for retailers and DTC brands. October sessions, orders, and demand rose year-over-year, supported by early holiday shopping. Nearly half of consumers planned to start before November, according to NRF.

Spending is holding steady, but confidence weakened as the government shutdown dragged on. The University of Michigan consumer sentiment index fell from 55.1 in September to 53.6 in October, then dropped to 50.3 in November, its lowest since mid-2022. Inflation remains sticky at ~3%, and short-term expectations eased to 3.2%, while long-term expectations climbed to 3.9%, signaling persistent uncertainty. Bank of America reports household card spending grew 2.4% YoY, but transaction volumes softened, suggesting consumers are paying more for less.

October delivered solid performance, but cautious consumers and macro uncertainty will shape the remainder of Q4. Brands that balance early-season momentum with value-driven messaging and retention strategies will be best positioned to sustain growth during the holiday season.

October 2025 Marketing Trends

Trend #1: Holiday Shopping Trends and Timing: What Marketers Need to Know

The holiday season remains the most critical period for retailers and brands, and understanding consumer behavior is key to maximizing performance. Consumer enthusiasm is strong, but shopping behaviors and timing are shifting.

Consumers Shopping Earlier, December Still Key

Ninety-one percent of consumers plan to celebrate the holidays, according to the National Retail Federation. Nearly half started shopping before November, Forbes reports, yet 60 percent will finish in December. Marketers need a two-phase approach: early campaigns to capture proactive buyers and sustained messaging for late shoppers.

Thanksgiving Week Is a Prime Window

Seventy percent of consumers plan to shop Thanksgiving week, Deloitte reports. a 23 percent increase over five years. Black Friday and Cyber Monday remain critical, but extending deals beyond the weekend can capture additional demand.

Cyber Monday Dominates Online Sales

Adobe Analytics projects Cyber Monday spending will reach $14.2 billion dollars, up from $13.3 billion dollars last year. This growth underscores the need for fast-loading, mobile-friendly sites and clear inventory and shipping details to reduce cart abandonment.

Less Time for Last-Minute Shoppers

There are only 24 days between Cyber Monday and Christmas. Standard shipping deadlines fall around December 17 to 19, with expedited options through December 22 to 23. Same-day delivery and in-store pickup will be essential for procrastinators. Marketers should highlight these options prominently across channels.

Trend #2: 2025 Why Walmart, Amazon, and Nordstrom Are Betting on Holiday Catalogs

Holiday marketing has been all about digital for years. This season, Walmart, Amazon, and Nordstrom are bringing back a classic: printed catalogs. Why? Because shoppers are tuning out endless online ads and craving something tangible.

Amazon: Nostalgia Meets Interactivity

Amazon has been mailing holiday toy catalogs for several years, but its 2025 edition is a masterclass in blending tradition with tech. Stickers for kids, QR codes for parents, and playful design turn a simple booklet into an experience that drives traffic back online.

Walmart: Omnichannel Meets Pop Culture

Walmart’s holiday push includes its first furniture catalog and a broader strategy to engage shoppers early. Walmart pairs print with its omnichannel strategy, blending nostalgia with convenience. Holiday marketing includes pop culture tie ins like Walton Goggins as the Grinch to spark buzz. By linking catalogs to Walmart Plus, fast delivery, and curated gift lists, the brand positions itself as both classic and tech forward.

Nordstrom: Curated Luxury at Scale

Nordstrom relaunched its holiday catalog this year with nearly 100 pages and over 800 gift ideas. Ninety percent of items are priced under $100, signaling a focus on accessibility alongside luxury. The catalog is part of a larger experiential campaign that includes in store gift shops, AI powered gift recommendations online, and immersive flagship events.

Print is not replacing digital. It is amplifying it. This is not nostalgia for its own sake. It is a calculated move to cut through digital fatigue and build trust this holiday season.

Trend #3: The Consumer Perspective on Direct Mail: Insights from Fresh Research

In a digital-first world, direct mail is proving to be a powerful differentiator. Research by Dr. Jonathan Zhang, featured in MIT Sloan Management Review, underscores why physical mail continues to resonate with consumers.

Direct Mail Drives Action

Over 70% of consumers rated direct mail as “very useful” or “extremely useful” in prompting a purchase, compared to roughly 50% for digital ads. When it comes to brand discovery and retention, nearly 80% said they were more likely to research a brand online or visit a store after receiving a printed piece. Digital ads, by contrast, often fade from memory once the browsing session ends.

Younger Audiences Are Engaged

Surprisingly, younger consumers are leaning into direct mail. Respondents aged 18–34 were 25% more likely to convert after handling physical mail, citing its personal feel and lower intrusiveness compared to persistent online pop-ups.

Breaking Through Digital Clutter

Nearly 80% of consumers report feeling oversaturated with digital advertising. Postcards, brochures, and catalogs stand out precisely because they offer a tangible alternative to the constant stream of online promotions.

Direct mail continues to be a proven driver of engagement and conversion. Its ability to cut through digital noise and foster trust makes it an essential component of today’s marketing mix.

Trend #4: Government Shutdown: A Stress Test for Retail

When the government shut down on October 1, it was not just a political stalemate. It was a stress test for U.S. consumers and businesses. For 43 days, uncertainty rippled through the economy, and October became ground zero for its impact.

Retail Looked Resilient But Confidence Cracked

Spending in October appeared steady, with payment data showing consistent debit and credit transactions. But consumer confidence cracked. The University of Michigan’s consumer sentiment index slipped from 55.1 in September to 55.0 in October, then fell to 50.3 by early November. Nearly half of Americans said they were less likely to make major purchases by November, up sharply from early October.

Holiday Outlook

October sets the tone for holiday shopping. Retailers typically ramp up promotions and inventory based on early signals, but this year those signals were distorted. Missed paychecks for hundreds of thousands of federal employees and disrupted SNAP benefits for millions tightened budgets. Even unaffected consumers felt the chill, often translating into smaller baskets and slower conversions.

Data Gap

Shutdowns freeze more than government services. They create a data blackout. October’s CPI and two jobs reports were never collected, leaving retailers without critical indicators for pricing and demand planning. In this environment, relying on real-time data is essential. Payment trends, loyalty activity, and social sentiment offer faster signals than official reports.

Trend #5: Lowe’s and Home Depot Forecast Revisions: What It Means for Retail

Recent earnings updates from Lowe’s and Home Depot reveal a cautious outlook for the home improvement sector. Both retailers reported modest revenue growth but adjusted profit forecasts downward, signaling ongoing pressure from high interest rates, a cooling housing market, and consumer uncertainty.

Lowe’s: Digital Strength Amid Flat Sales

Lowe’s reported EPS of $3.06, beating estimates, while revenue slightly missed at $20.81 billion. The company raised its full-year sales outlook to about $86 billion, expects comparable sales to remain flat, and narrowed EPS guidance to $12.25. Digital sales were a standout, up 11.4%, driven by continued investment in the Pro segment.

Home Depot: Lower Profit Outlook

Home Depot posted EPS of $3.74, below expectations, with revenue slightly ahead at $41.4 billion. The retailer projects roughly 3% sales growth, aided by acquisitions, but anticipates a 5% EPS decline. Weak demand for big-ticket items, fewer storm-related purchases, and historically low housing turnover remain key challenges.

Broader Retail Outlook

The cautious tone from these leaders signals ripple effects across the retail landscape. Big-ticket categories such as furniture, appliances, and décor are likely to experience similar softness, impacting brands like Williams-Sonoma, RH, and Best Buy. DIY-focused chains may see slower traffic, while Pro-oriented businesses could hold up better. Value retailers such as Walmart and Target may benefit as consumers trade down to more affordable options.

Jump to Section

Marketing KPIs: October 2025 Trends by Industry

Marketing KPIs: October 2025 Trends by Company Revenue

$100M+ | $15M-$100M | $0-$15M

Marketing KPIs: October 2025 Trends by Industry

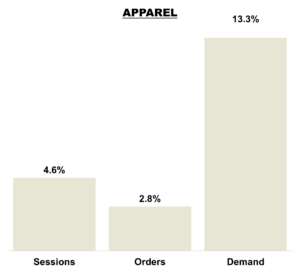

Apparel Industry

Sessions up 4.56%, orders up 2.76%, and demand surging 13.33%. Strong revenue growth outpacing traffic and orders suggests higher average order values and healthy consumer spending. While conversion efficiency can improve, overall momentum remains positive heading into the holiday season.

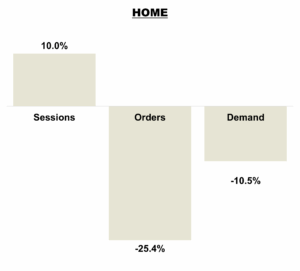

Home Brands

The Home category showed mixed year-over-year results, with sessions up 9.97%, but orders down 25.39% and demand declining 10.45%. The traffic increase suggests strong shopper interest, yet the steep drop in orders points to conversion challenges, possibly due to softer consumer intent, reduced promotional activity, or higher price sensitivity. Despite more visitors, fewer are completing purchases, indicating a need to reassess on-site experience, offer strategy, and product positioning.

Outdoor Brands

The Outdoor category saw modest year-over-year traffic growth with sessions up 1.58% and orders nearly flat at -0.10%, while demand surged 14.50%. This indicates that although purchase volume held steady, shoppers are spending significantly more per order, due to higher price points or a shift toward premium products. Overall, the category shows stable engagement and strong revenue efficiency, suggesting resilient consumer interest heading into the holiday season.

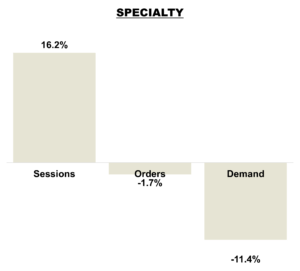

Specialty Retailers

The Specialty category experienced strong traffic growth with sessions up 16.21%, but orders fell 1.72% and demand declined 11.38%. While more visitors came to the site, fewer are converting and overall spending decreased, suggesting conversion or pricing challenges. This gap highlights an opportunity to optimize the shopping experience and promotions to better translate high interest.

Marketing KPIs: October 2025 Trends by Company Revenue

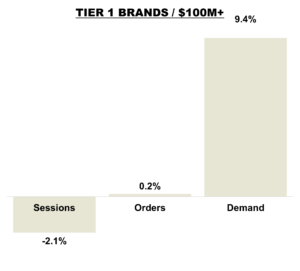

Tier 1 Brands

Tier 1 brands saw slightly lower traffic year-over-year with sessions down 2.12%, while orders held steady at +0.15% and demand rose 9.36%. The modest traffic dip paired with strong revenue growth indicates higher average order values and effective merchandising or pricing strategies. Despite softer site visits, these brands are driving stronger monetization per shopper, reflecting solid brand strength and purchase intent heading into Q4.

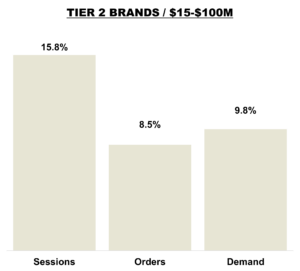

Tier 2 Brands

Tier 2 brands delivered strong year-over-year growth, with sessions up 15.75%, orders rising 8.51%, and demand up 9.78%. The broad-based gains reflect healthy traffic expansion and solid consumer conversion, supported by effective marketing and product strategies. While order growth trailed traffic slightly, overall performance signals robust momentum and strengthening shopper engagement heading into the holiday season.

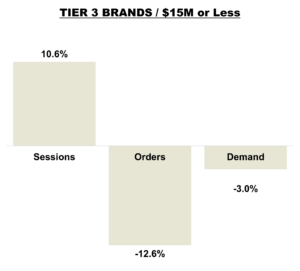

Tier 3 Brands

Tier 3 brands saw solid traffic growth with sessions up 10.60%, but orders declined 12.58% and demand fell 2.98% year-over-year. The gap between rising site visits and declining sales suggests weaker conversion performance and potential pricing or competitiveness challenges. Despite increased shopper interest, smaller brands may need to refine targeting, promotions, and on-site experience to better translate traffic into revenue.