We compiled these trends from over 100 brands, comparing year-over-year data for the date range August 1, 2025, to August 31, 2025.

August 2025: Consumer Spending Holds Strong as Retailers Eye Fall Promotions

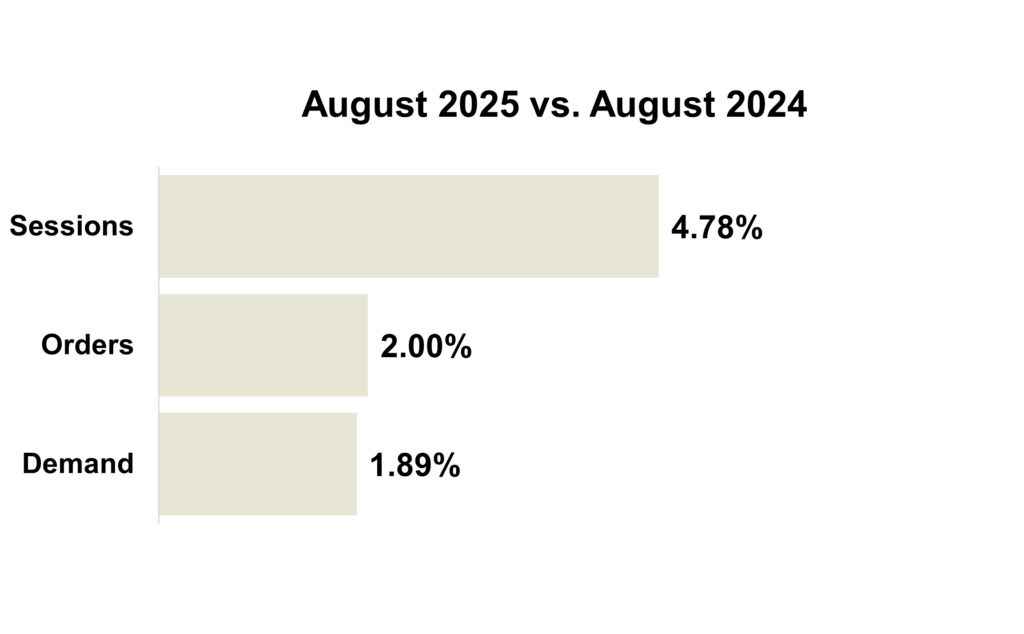

Retailers are closing out Q3 and entering the fall season with cautious optimism, buoyed by a strong performance in August. Sessions rose by 4.78%, while orders and overall demand increased by 2.00% and 1.89%, respectively, compared to the same period last year.

However, this positive outlook is balanced by signs of cooling in the U.S. economy. Slowing job growth and a slight rise in the unemployment rate to 4.3% point to a softening labor market. Ongoing inflationary pressures, driven by tariffs and the rising cost of consumer goods, also remain a concern.

Despite these headwinds, consumer demand continues to show resilience. According to Deloitte, discretionary spending has increased for three consecutive months, even as financial confidence remains low. Shoppers are selectively spending on items like apparel and leisure, while bracing for higher prices on essentials such as groceries and gas.

August’s data highlights that while consumers are willing to spend, they are becoming more discerning and value-conscious. To capture consumer attention, brands must adapt their strategies, focusing on value and targeted promotions. Upcoming events like Halloween, Black Friday, and Cyber Monday will be pivotal for driving conversions and securing sales in a highly competitive retail landscape.

Jump to Section

Marketing KPIs: Trends by Industry

Marketing KPIs: Trends by Company Revenue

$100M+ | $15M-$100M | $0-$15M

August 2025 Marketing Trends

Trend #1: Economic Outlook: Fall 2025

Navigating a Soft Landing Amid Mixed Signals

As we move into the final quarter of 2025, the U.S. economy is showing signs of resilience, even as challenges persist. Recent data points to a potential soft landing, where slower but stable growth is accompanied by easing inflation and a cooling labor market. While challenges remain, the overall picture is one of cautious optimism.

Growth & Employment:

The economy is expected to expand at a modest pace of 1.3%–1.7% through the fourth quarter. This steady growth is being driven by continued consumer spending and a recent rebound in business investment. While job creation has slowed in recent months, projections show an average of 130,000+ new jobs per month, with unemployment stabilizing around 4.2%.

Inflation & Interest Rates:

Core inflation remains sticky, hovering near 3%, but long-term expectations are anchored close to the Fed’s 2% target. At its September meeting, the Federal Reserve opted to cut interest rates by 25 basis points, lowering the benchmark federal funds rate to a range of 4.00%–4.25%.

What to Watch:

- September Jobs Report: A key indicator for Fed policy direction.

- Consumer Sentiment: Will confidence rebound as inflation eases? A rebound in sentiment could fuel further spending and economic momentum.

- Global Risks: Geopolitical tensions and new tariffs remain wild cards that could disrupt supply chains and impact the economic outlook.

Bottom Line:

While risks remain, the outlook for Fall 2025 is cautiously optimistic. Retailers should anticipate a value-driven holiday season, with consumers prioritizing essentials and seeking early deals, particularly during the critical five-day shopping sprint from Thanksgiving to Cyber Monday.

Trend #2: A Retailer’s Guide to Halloween: Turning Spooky Season into Sales Success

Halloween is more than just costumes and candy, it’s a strategic opportunity for marketers to drive engagement, boost sales, and build lasting brand loyalty. With 72% of households participating in Halloween-related activities, and spending projected to reach $11.7 billion, the “spooky season” is a prime opportunity to drive sales and connect with customers.

Strategic Moves for Halloween Campaigns:

- Embrace the Halloween Aesthetic: Halloween is a visual holiday, so embrace the theme everywhere. Give your website and social media a temporary makeover with seasonal colors and spooky visuals.

- Drive Engagement Through Interactivity: Try a “trick-or-treat” style promotion with a mystery discount at checkout or a digital scavenger hunt on your website. Add festive packaging touches like spooky inserts or stickers.

- Treat Your Loyal Customers: Reward your most loyal customers with a special Halloween “treat.” A unique discount code or an exclusive sneak peek at a new product launch, not only drives sales but also strengthens customer loyalty.

- Make Social Media Scream: Host user-generated content (UGC) contests encouraging customers to share how they use your products for their celebrations. Share short-form videos on TikTok and Instagram Reels or use polls, quizzes, and Q&A stickers on Stories to engage your audience directly.

By weaving a Halloween narrative into your product, marketing, and customer experience, you can create a strong emotional connection that drives sales and brand loyalty long after the last piece of candy is gone.

Trend #3: Maximizing Direct Mail for Black Friday and Cyber Monday

Direct mail can be a powerful tool for retailers during Black Friday and Cyber Monday (BFCM). It’s a great way to cut through the digital noise and connect with customers. As inboxes overflow and ad fatigue sets in, a well-timed physical mailer can grab attention and drive conversions.

Here’s how to make your direct mail strategy work harder for BFCM:

1. Start Early to Build Anticipation

Begin your mailings 2–3 weeks before BFCM to build anticipation. Postcards or mini catalogs can preview upcoming deals, offer early access, and link to curated landing pages via QR codes.

2. Personalize Thoughtfully

Use data such as past purchases, browsing behavior, or location to guide your messaging. Variable printing makes it easy to adjust product recommendations, highlight nearby store events, or include custom discount codes.

3. Coordinate with Digital

Direct mail works best when integrated with email, SMS, and social media. Reinforce messaging across channels and use QR codes or personalized URLs to track engagement and guide users online.

4. Leverage Postal Retargeting

Postal retargeting lets you follow up with website visitors who didn’t convert. It’s a useful way to re-engage interested shoppers and complement your digital retargeting efforts.

5. Track and Analyze Results

Avoid a ‘set it and forget it’ approach. Use campaign results to help understand what offers are most effective, which customer segments respond best and how to optimize future campaigns. By analyzing your results, you can continuously improve your direct mail strategy and maximize your return on investment.

A thoughtful direct mail strategy can help you connect meaningfully with customers during the busiest shopping season of the year. With smart timing, personalization, and digital integration, direct mail can become your highest-performing channel this holiday season.

Trend #4: The End of De Minimis and What It Means for Retailers

In a major shake-up for global commerce, the U.S. has officially ended the de minimis exemption, which previously allowed imports under $800 to enter duty-free. Enacted by executive order, this change is already reshaping the retail landscape, especially for e-commerce platforms and small businesses that relied on low-cost international sourcing.

What’s Changing

All imports, regardless of value, are now subject to tariffs and stricter customs procedures. Retailers face rising costs, longer shipping times, and increased compliance burdens. Analysts estimate the average U.S. household could see an annual cost increase of $136.

The Opportunity Behind the Disruption

While the short-term impact is challenging, this policy shift opens the door to long-term strategic gains:

- Level Playing Field: Domestic retailers can now better compete with overseas sellers

- Supply Chain Resilience: Nearshoring and reshoring become more attractive and viable

- Brand Differentiation: Emphasizing sustainability, ethical sourcing, and quality can justify higher prices

- Operational Innovation: New fulfillment models and smarter inventory systems can offset rising costs

With the end of de minimis, forward-thinking retailers have a unique opportunity to gain a competitive advantage, strengthen their market position, and deliver more value to their customers.

Jump to Section

Marketing KPIs: Trends by Industry

Marketing KPIs: Trends by Company Revenue

$100M+ | $15M-$100M | $0-$15M

Marketing KPIs: Trends by Industry

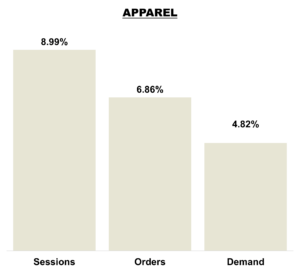

Apparel Industry

The Apparel Industry showed solid performance in August. Sessions rose +8.99%, orders increased +6.86%, and demand grew +4.82%, signaling stronger consumer engagement and spending.

Traffic and order volumes are on an upward trajectory, earlier softness in conversion rates appears to be stabilizing.

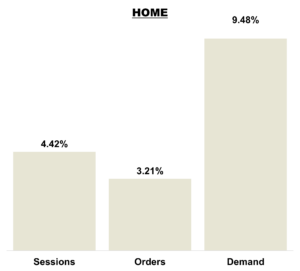

Home Brands

Home brands showed modest improvement in August, with sessions up +4.42%, orders increasing +3.21%, and demand rising +9.48%.

While not as explosive as July’s surge, the category remains on solid footing.

The strong demand growth signals that consumers are still investing in their living spaces. This steady performance lays a strong foundation for future gains, especially if brands can capitalize on evolving home trends.

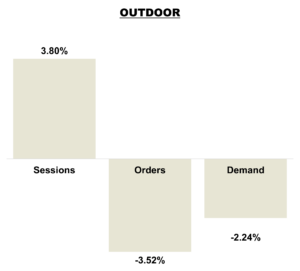

Outdoor Brands

The Outdoor Industry lost momentum in August, with sessions growth easing to +3.80%, orders declining –3.52%, and demand falling into negative territory at –2.24%. Despite the pullback, traffic remains healthy, indicating sustained interest.

This followed solid growth in July, when sessions increased +11.80%, orders rose +2.98%, and demand grew +5.66%.

The shift from broad growth in July to contraction in August signals softening demand and highlights risks to conversion heading into late Q3.

Specialty Retailers

Specialty Brands continue to face pressure this year, with August sessions down –3.02%, orders falling –5.40%, and demand declining –9.83%.

This followed July’s declines, when sessions fell –1.44%, orders contracted –5.82%, and demand slid –6.94%, reflecting broad weakness across performance metrics.

Brands that can differentiate through innovation, targeted promotions, or refreshed positioning may be able to reverse the trend.

Marketing KPIs: Trends by Company Revenue

Tier 1 Brands

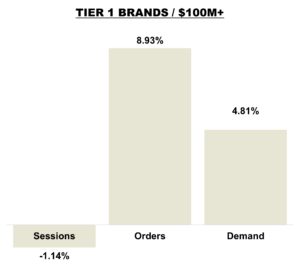

Tier 1 brands experienced a slight moderation in August, with sessions dipping –1.14%. However, orders rose +8.93% and demand grew +4.81%. Fewer visitors drove stronger conversions and higher spend, signaling a shift toward quality over quantity.

In contrast, July saw robust growth across all metrics: sessions increased +7.85%, orders climbed +8.21%, and demand surged +10.28%

This divergence highlights Tier 1 resilience. Sustaining momentum into late Q3/Q4 will hinge on reaccelerating traffic to fuel continued demand.

Tier 2 Brands

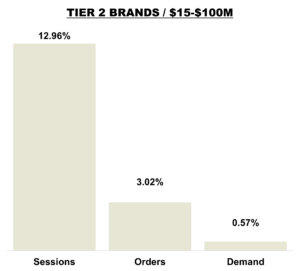

In August, Tier 2 brands experienced conversion challenges despite a notable uptick in traffic. Sessions rose by +12.96%, signaling sustained consumer interest and engagement. However, orders increased by just +3.02%, and overall demand saw a marginal lift of +0.57%, underscoring persistent friction in the path to purchase.

While shopper engagement remains strong, conversion efficiency is lagging. A trend likely driven by heightened price sensitivity and shifting consumer priorities among value-conscious audiences.

Tier 3 Brands

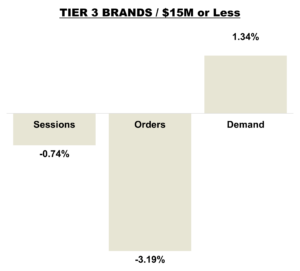

Tier 3 brands showed signs of softness in August, with sessions down -0.74% and orders declining -3.19%, while demand edged up +1.34%.

This follows mixed results in July, where sessions rose by 6.42%, and demand grew +9.76%, yet orders declined -3.05%.

Increasing engagement and improving conversion rates will be particularly important for smaller brands heading into the holiday season.